Imagine building a house out of Lego blocks. Each piece snaps together perfectly - doors connect to walls, windows fit into frames, and the roof locks snugly on top. Now imagine one of those blocks is cracked. Not broken, just slightly off. You don’t notice it until the whole structure collapses in seconds. That’s what DeFi composability looks like in practice.

The Magic of Money Legos

Decentralized Finance, or DeFi, was built on the idea that financial services shouldn’t need banks, brokers, or middlemen. Instead, code does the work. Protocols like Aave, Uniswap, and Compound act like digital financial tools you can plug into each other. Want to borrow ETH? Use Aave. Want to trade it for stablecoins? Swap it on Uniswap. Want to earn interest on those stablecoins? Deposit them into Yearn Finance. All without logging in, without ID checks, without waiting days for approval. This is composability. It’s why DeFi grew so fast. Developers didn’t need to build everything from scratch. They reused what already worked. Aave’s lending engine became the backbone of dozens of yield farms. Uniswap’s price feed powered automated trading bots. This created an ecosystem where innovation exploded - new products popped up every week. But this same flexibility is also its biggest weakness.How One Failure Can Bring Down Ten Protocols

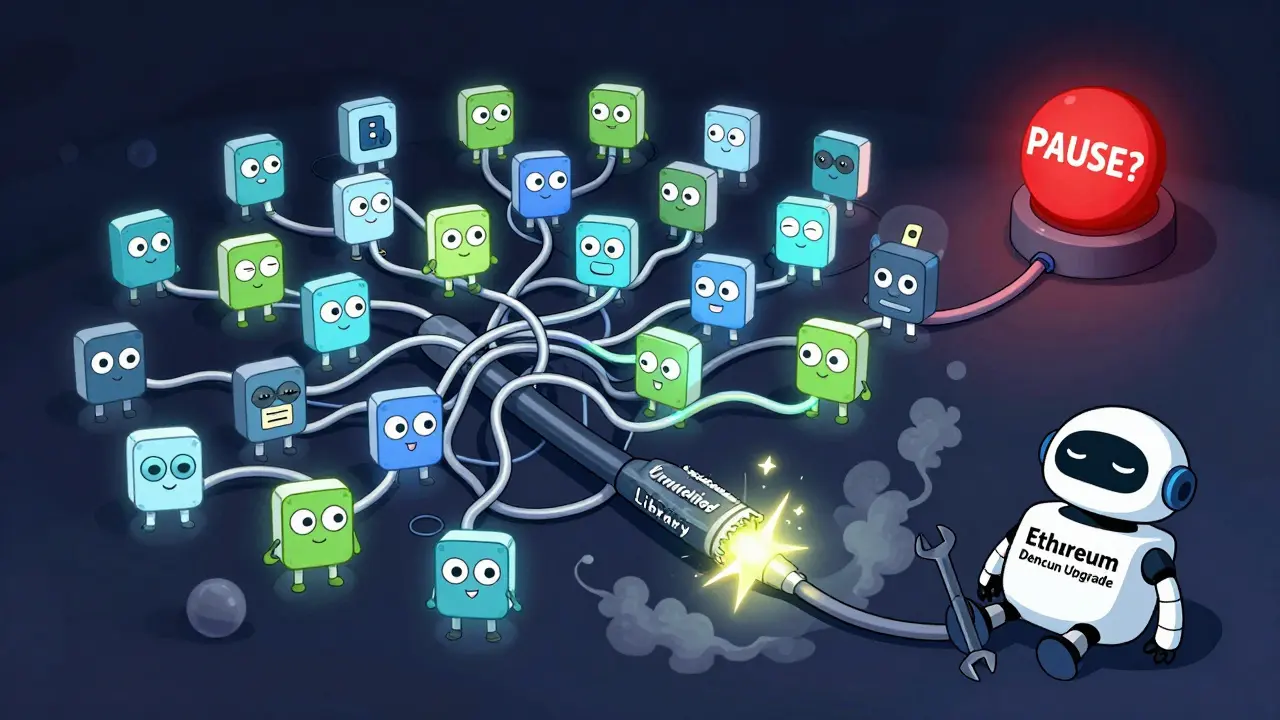

The problem isn’t that individual protocols are insecure. It’s that they’re all connected. When one breaks, the damage doesn’t stop there. It spreads. Take the Cream Finance exploit in February 2021. Attackers used flash loans - instant, uncollateralized loans - to artificially inflate the price of a token on Uniswap. Then they used that fake price to borrow far more ETH from Aave and Compound than they should’ve been allowed. When they sold the inflated token, prices crashed. The protocols that trusted Uniswap’s price feed lost over $130 million. Aave and Compound didn’t get hacked. They just believed a lie. And because they were connected to Cream, the loss rippled through their users’ accounts. Or look at the Ledger ConnectKit incident in February 2023. A popular open-source library used by dozens of DeFi wallets had a flaw. It didn’t properly verify transaction approvals. Attackers tricked users into signing malicious transactions that drained their wallets. $484,000 vanished across 17 different platforms - not because each one was hacked, but because they all used the same broken piece of code. These aren’t rare events. They’re inevitable.Why DeFi Can’t Hit Pause Like Banks Do

In traditional finance, when things go wrong, humans step in. A bank can freeze an account. A regulator can halt trading. A CEO can call a meeting and shut down a risky product. DeFi doesn’t work that way. There’s no CEO. No central office. No one with a big red button. When a flash crash hits, or a price oracle gives wrong data, the code keeps running. Smart contracts don’t pause. They don’t ask for help. They just execute - even if it means liquidating every user’s position at a 90% discount. And because so many protocols rely on the same oracles, the same liquidity pools, the same token standards, a single bad signal can trigger hundreds of liquidations at once. The March 2023 QuickSwap attack showed this perfectly. A vulnerability in Curve’s liquidity pool oracle let attackers manipulate the price of a stablecoin pair. That fake price was used by QuickSwap to approve loans. When the price snapped back, users got liquidated. $188,000 lost - all because one price feed was corrupted.

The Hidden Dependencies You Can’t See

Most users think they’re just interacting with one app - maybe a yield optimizer or a lending platform. But behind the scenes, they’re tied to a dozen other protocols. A single vault in Yearn Finance might be pulling liquidity from Aave, swapping tokens on SushiSwap, and using Chainlink for price data. If any one of those three fails, your returns vanish. And here’s the scary part: no one can map all these connections. There’s no global directory of which protocol depends on which. Even developers don’t always know. A new DeFi tool might use an old library that’s been abandoned. Or it might call a contract that was deployed by someone who vanished years ago. These are invisible links - like wires buried under your house that you didn’t know were there. A 2023 analysis of 200 major DeFi protocols found that only 35% had been audited by reputable third-party firms. The rest? Built fast, launched faster, and never properly checked. That’s not just risky - it’s reckless.What’s Being Done to Fix It?

Some teams are trying. Aave now uses timelocks - a 48-hour delay before any major change takes effect. That gives users time to react if something looks wrong. Uniswap has adopted formal verification - math-based proof that code behaves exactly as intended. Nexus Mutual, a DeFi insurance platform, now insures over $1.2 billion in assets. But that’s less than 1% of the total value locked in DeFi. Ethereum’s Dencun upgrade, launched in early 2024, reduces congestion and improves transaction finality - meaning fewer failed transactions and less chaos during spikes in activity. But upgrades don’t fix bad code. They just make the system a little less fragile. The real solution? Developers need to stop treating composability like a feature and start treating it like a risk. That means:- Only using well-audited, battle-tested contracts

- Limiting how many external protocols your app depends on

- Adding circuit breakers - automatic stops if prices move too fast

- Using multiple oracles, not just one

- Testing for cascading failure scenarios, not just single-point bugs

What Should You Do as a User?

If you’re earning 15% APY by stacking Aave, Uniswap, and Yearn, congratulations - you’re using DeFi the way it was meant to be used. But that doesn’t mean you’re safe. Here’s what to do:- Never put more than 10-15% of your crypto portfolio into complex yield strategies

- Check what contracts your wallet is interacting with - use tools like DeFi Saver or Zapper to see the full path

- Stay away from protocols that haven’t been audited by at least two reputable firms

- Keep a portion of your assets in simple, single-protocol positions (like ETH in Ethereum staking or USDC in a basic savings wallet)

- Don’t assume “popular” means “safe.” Some of the biggest exploits happened on the most-used platforms

The Future Is Either Safer or It’s Over

DeFi’s promise was freedom - freedom from banks, freedom from gatekeepers, freedom to build anything. But freedom without responsibility is chaos. The protocols that survive the next 24 months won’t be the ones with the flashiest yields or the most viral marketing. They’ll be the ones that admit: complexity is dangerous. They’ll be the ones that audit every line of code, limit dependencies, and build in safety nets. If you’re building in DeFi, stop chasing speed. Start chasing safety. If you’re using DeFi, stop chasing yields. Start asking questions. The system is too interconnected to fail quietly. When the next collapse happens - and it will - it won’t be a single protocol that falls. It’ll be half the ecosystem. And if you’re not prepared, you won’t just lose money. You’ll lose trust - in the whole idea of DeFi.What is DeFi composability?

DeFi composability is the ability of different decentralized finance protocols to interact and build on top of each other like Lego blocks. For example, a lending protocol like Aave can be used by a yield aggregator like Yearn Finance, which in turn uses a decentralized exchange like Uniswap. This allows rapid innovation but also creates hidden dependencies where one failure can trigger others.

Can a single smart contract crash the whole DeFi ecosystem?

Yes. If a widely used contract - like a price oracle, a token standard, or a common library - has a vulnerability, attackers can exploit it to trigger cascading failures. Examples include the Cream Finance exploit (2021), which used a manipulated price feed to drain funds from multiple lending protocols, and the Ledger ConnectKit breach (2023), which compromised 17 DeFi apps through a single flawed library.

Why can’t DeFi pause like traditional finance during a crisis?

Traditional finance has humans in charge - banks can freeze accounts, regulators can halt trading, CEOs can shut down risky products. DeFi runs on code. Once a smart contract is deployed, it executes automatically, 24/7, with no way to stop it. If a price feed is manipulated, liquidations happen instantly. There’s no emergency button.

How do flash loans contribute to DeFi risks?

Flash loans allow users to borrow huge amounts of crypto without collateral - as long as they repay it within the same transaction. Attackers use them to artificially inflate or deflate token prices on decentralized exchanges. That fake price is then used to borrow more from lending protocols or trigger liquidations. The entire attack happens in seconds, with no risk to the attacker - only to the protocols and users who trusted the manipulated data.

Are DeFi insurance protocols like Nexus Mutual enough to protect me?

No. As of late 2023, Nexus Mutual insured about $1.2 billion - but total value locked in DeFi was over $50 billion. That’s less than 3% coverage. Insurance helps, but it’s not a safety net. Most claims are slow to pay out, and many exploits fall outside policy terms. Your best protection is limiting exposure and avoiding complex, multi-protocol strategies.

What’s the safest way to use DeFi right now?

Use simple, audited protocols with limited dependencies. Stick to major platforms like Aave, Uniswap, or Compound that have been tested for years. Avoid yield farms that combine more than two or three protocols. Keep 80-90% of your crypto in low-risk positions like ETH staking or USDC savings. Never risk more than 10-15% of your portfolio in complex DeFi strategies.

Will Ethereum’s Dencun upgrade fix composability risks?

No. Dencun improves transaction speed and reduces network congestion, which helps prevent some failures during high traffic. But it doesn’t fix bad code, vulnerable oracles, or dangerous smart contract interactions. Composability risks are about design, not performance. Upgrades help, but they’re not a solution.

How many DeFi protocols have been properly audited?

Only about 35% of the top 200 DeFi protocols have undergone comprehensive third-party audits, according to a 2023 analysis. Many rely on basic checks or audits from unknown firms. A protocol being “popular” doesn’t mean it’s secure. Always check audit reports before using any DeFi app.

Angelina Jefary

18 Jan 2026 at 13:48Okay but let’s be real - this whole DeFi thing is just a Ponzi scheme with better branding. They’re not building financial freedom, they’re building a house of cards out of abandoned GitHub repos and drunk devs who think ‘it works on my machine’ counts as an audit. And don’t even get me started on those ‘oracle’ scams. Chainlink? More like ChainLiar. They’re all just feeding each other fake numbers like kids playing telephone in a cave. Someone’s gonna wake up one day and realize the entire $50B ecosystem is running on a single line of bad JavaScript from 2019. And no one’s gonna be able to fix it because the ‘code is law’ crowd would rather watch the world burn than admit they made a mistake.