When you hold a governance token, you’re not just owning a piece of crypto-you’re holding a vote. That vote can decide whether a protocol raises fees, changes its security rules, or spends millions from its treasury. This isn’t theoretical. It’s real, on-chain power. And yet, most people who hold these tokens never vote. Why? Because voting power doesn’t automatically mean influence. It only creates worth when it’s used.

What Exactly Is a Governance Token?

A governance token is a digital asset that gives its holder the right to vote on changes to a decentralized protocol. Think of it like owning shares in a company-but instead of electing a board of directors, you vote directly on code updates, fee structures, and how money is spent. The most famous examples are UNI (Uniswap), MKR (MakerDAO), and AAVE (Aave). These aren’t just speculative assets. They’re the legal and operational backbone of entire financial systems running on blockchain.

Unlike regular tokens, governance tokens don’t pay dividends. Their value doesn’t come from cash flow. It comes from control. The more tokens you hold, the more votes you get. One token = one vote. That sounds fair, until you realize that 1% of holders control over 60% of the votes across most major protocols. That’s not democracy. It’s plutocracy.

How Voting Power Turns Into Real Value

Value isn’t created by holding tokens-it’s created by using them. Protocols with active governance see higher user retention and faster treasury growth. Delphi Digital found that protocols with over 15% voter participation grew their treasuries 23.7% faster than those with low engagement. Why? Because decisions made by the community are more aligned with real user needs.

MakerDAO, for example, has executed over 110 governance proposals since 2018. Each vote changed something tangible: interest rates, collateral types, emergency shutdown triggers. These weren’t symbolic votes. They kept the system alive during market crashes. When ETH dropped 70% in 2022, MakerDAO’s community voted to adjust collateral requirements to prevent mass liquidations. That saved billions in user funds.

Uniswap’s 2023 proposal to introduce trading fees was a different story. Only 1.3% of UNI holders voted. The proposal passed-but it felt hollow. The system worked technically, but it didn’t feel like a community decision. That’s the gap between governance token value and actual governance.

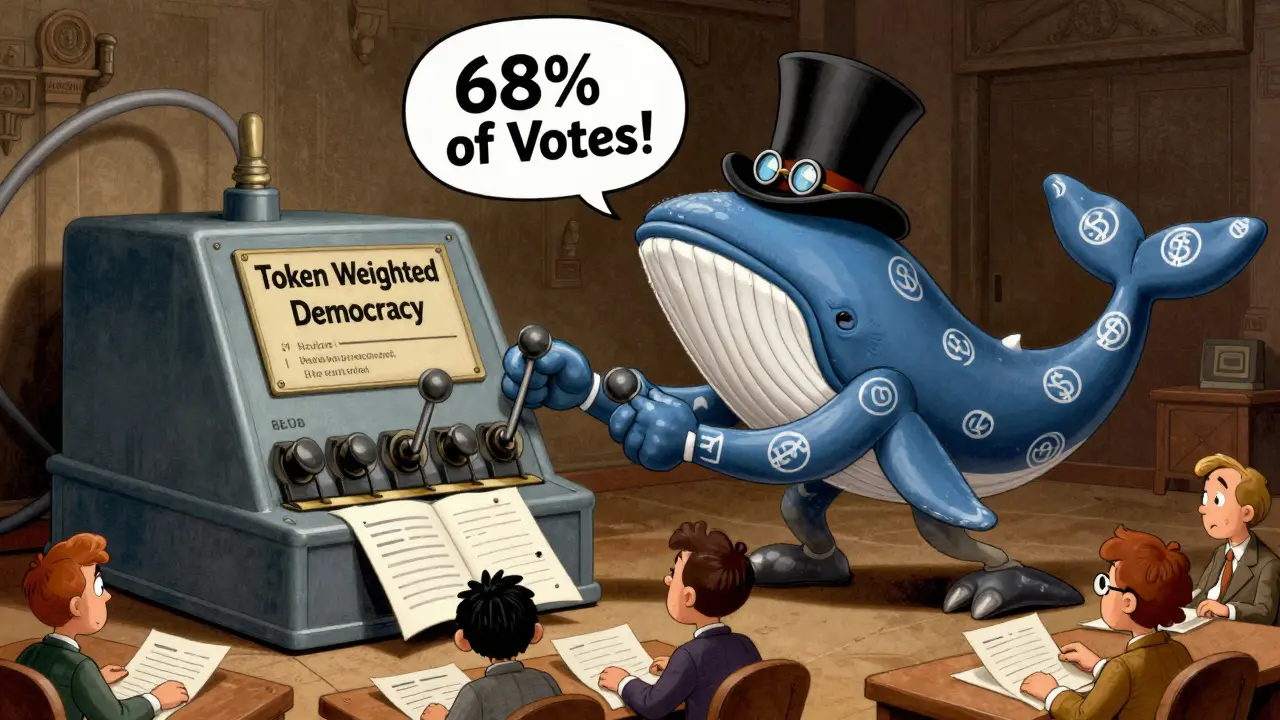

The Plutocracy Problem

Token-weighted voting looks democratic on paper. In practice, it’s dominated by whales. Chainalysis data shows the top 100 MKR holders control 68.3% of voting power. For UNI, it’s 62.1%. These aren’t random users. They’re hedge funds, venture capital firms, and early investors who bought in when prices were low.

This creates a dangerous feedback loop. The more tokens a whale holds, the more influence they have. The more influence they have, the more they can push proposals that benefit their holdings-even if it hurts the broader network. In 2022, an attacker borrowed $250 million in ETH to buy enough voting power to take over Beanstalk Farms. They passed a proposal that drained the treasury. The system worked exactly as coded. But it wasn’t secure. It was exploitable.

Vitalik Buterin called token-weighted voting “fundamentally flawed.” He’s not alone. Researchers at Cornell found that protocols with concentrated voting power had 37% higher price volatility and 29% lower liquidity. Why? Because markets distrust systems where a few players can swing outcomes.

Why Most People Don’t Vote

If governance is so powerful, why do 90% of token holders sit idle?

Reddit data from over 1,200 users shows 68% say they don’t vote because they don’t have time to research proposals. Another 25% say they don’t understand the technical implications. A typical proposal might involve changing a smart contract parameter, adjusting oracle feeds, or modifying fee splits. Each one requires hours of reading, analysis, and sometimes even understanding Ethereum gas mechanics.

Uniswap’s proposal documentation scores just 3.1 out of 5 on clarity. MakerDAO’s scores 4.3. That difference shows. MakerDAO has 3x the voter participation rate of Uniswap-not because its holders are smarter, but because the system is easier to use.

And then there’s delegation. Most people don’t vote directly. They delegate their votes to someone else-a trusted community member, a governance DAO, or a professional delegate. Tally.xyz processed over 1.2 million delegated votes in Q3 2023. That’s not participation. That’s outsourcing.

One Reddit user wrote: “I hold 5,000 UNI but have never voted. I delegated to a trusted member, but I feel disconnected.” That’s the quiet crisis of governance tokens. Power is there. But ownership? It’s fading.

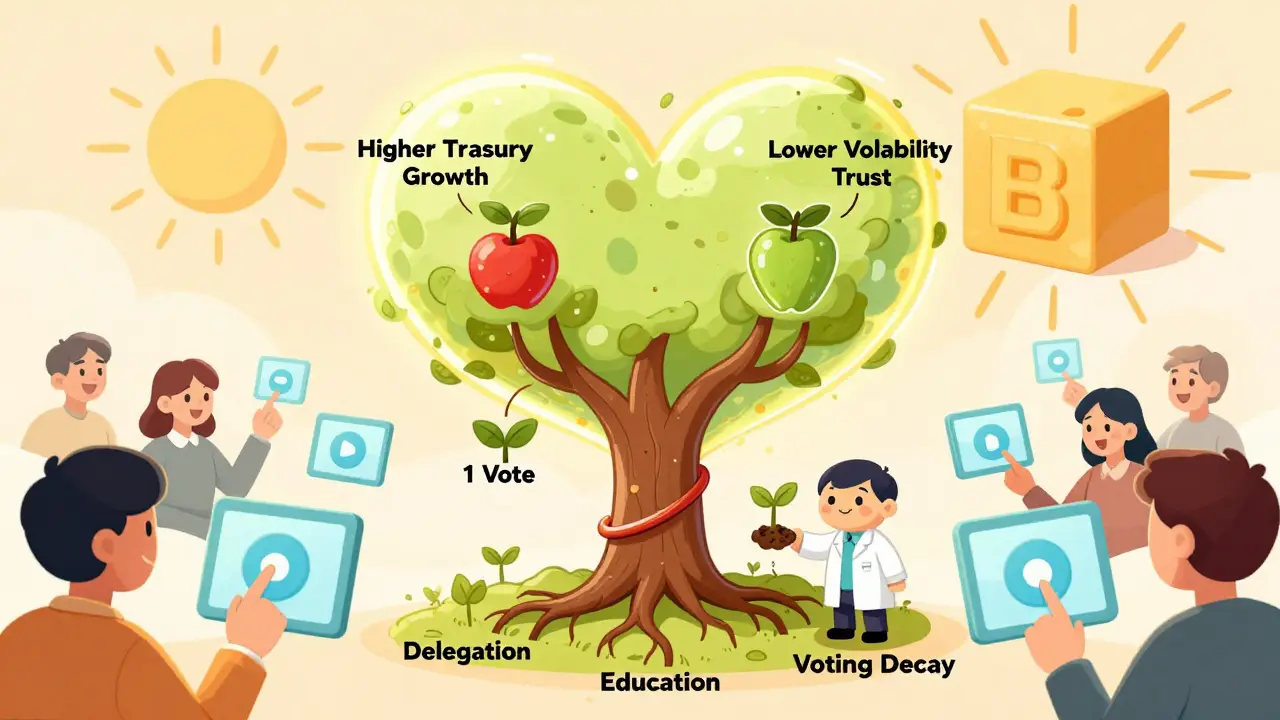

New Models Are Emerging

Some projects are trying to fix this. Aave introduced a dual governance system where proposals need both token votes and community approval. MakerDAO now lets holders assign “mandates”-delegates who only vote on specific topics they’re experts in, like liquidity or risk management.

Optimism’s “Citizen House” uses quadratic voting, where each additional vote costs more than the last. This prevents whales from dominating. Gitcoin uses the same system for funding public goods. And Juicebox lets communities fund projects directly through tokenized contributions, separating governance from pure financial ownership.

Even more promising: voting power decay. A University of Pennsylvania study showed that if voting rights expire after 30 days of inactivity, participation jumps 58%. It forces people to stay engaged-or lose their voice. That’s not a bug. That’s a feature.

What’s Next for Governance Tokens?

Governance tokens are no longer optional. 68% of new DeFi protocols launch with them. They’re the standard. But the real question isn’t whether they’ll survive-it’s whether they’ll evolve.

Right now, most governance tokens are treated like stocks. Buy. Hold. Hope. But that’s not how they’re meant to work. Their value isn’t in price appreciation. It’s in participation. The more people vote, the more resilient the system becomes. The more resilient the system, the more trust it earns-and the more value it creates.

Uniswap just allocated $512,500 in UNI to fund governance education. That’s a sign. They know the system is broken. And they’re trying to fix it.

The future belongs to protocols that treat governance not as a checkbox, but as a living process. That means better documentation. Simpler interfaces. Paid voter incentives. Community training programs. Governance isn’t a feature. It’s the foundation.

How to Start Participating

If you hold a governance token, here’s how to turn your holdings into real influence:

- Check your wallet balance. Do you have enough to submit a proposal? (Uniswap: 2.5M UNI, MakerDAO: 5% of supply)

- Subscribe to the project’s governance forum (usually on Snapshot.org or Discord)

- Read one proposal per week. Start small-look for fee changes or treasury spending, not complex code updates

- Use Tally.xyz or Daovatar to track proposals and see how others are voting

- Delegate your vote if you don’t have time-but pick someone you trust, not just the top delegate

- Vote. Even once. It matters more than you think.

You don’t need to be a coder. You don’t need to understand smart contracts. You just need to care enough to click “yes” or “no.”

Governance tokens aren’t magic. They don’t create value by existing. They create value when people use them. And right now, most people aren’t using them at all.

Are governance tokens the same as regular crypto tokens?

No. Regular tokens like ETH or SOL are used for transactions, staking, or as digital cash. Governance tokens give you voting rights on protocol changes. You can hold both-but only governance tokens let you shape the future of the network.

Can I lose money by voting on governance proposals?

You won’t lose tokens just by voting. But if you vote for a proposal that harms the protocol-like lowering security or draining the treasury-it can cause the token’s price to drop. Your vote has real-world consequences. Always research before voting.

Do I need to lock my tokens to vote?

It depends on the protocol. MakerDAO requires you to lock MKR in a smart contract to vote. Uniswap and Aave let you vote directly from your wallet using Snapshot.org. Check the official governance page for your token’s rules.

Why do some governance tokens have higher participation than others?

It’s usually about usability. MakerDAO has clear documentation, weekly summaries, and a well-organized forum. Uniswap’s process is complex and hard to follow. Projects that invest in education and simplify voting see 40%+ higher participation. Good design matters as much as the tech.

Is it safe to delegate my voting power?

Yes, as long as you choose wisely. Delegation doesn’t give anyone access to your tokens or wallet. It only lets them vote on your behalf. Look for delegates with public track records, clear voting principles, and active community engagement. Avoid anonymous or high-frequency delegators.

Can the government shut down governance tokens?

Not the protocol itself. But regulators like the SEC are watching. SEC Chair Gary Gensler said some governance tokens could be classified as securities. That could mean legal risks for projects that don’t comply. It won’t kill the technology-but it could force changes in how tokens are distributed and used.

Buddy Faith

17 Dec 2025 at 10:36This whole system is rigged. The whales own the votes, the devs own the whales, and you think your 500 UNI means something? Lol. They wrote the code to let them steal. You're not voting. You're performing a ritual for people who already won.