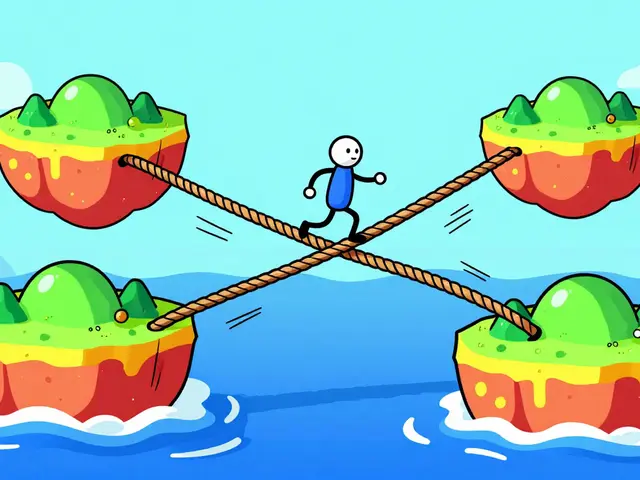

When you send a crypto transaction on Ethereum, you don’t want to wait hours or pay $50 in fees. That’s why Layer 2 solutions like rollups exist. They move transactions off the main Ethereum chain, process them faster, and bring the results back - all while keeping security intact. But not all rollups are the same. Two main types dominate the space: optimistic rollups and zero-knowledge rollups. They sound similar, but they work in completely different ways. Choosing between them isn’t just about tech specs - it’s about speed, cost, and trust.

How Optimistic Rollups Work

Optimistic rollups operate on a simple idea: assume everything is fine until someone proves it’s not. When you send a transaction, it’s bundled with dozens or hundreds of others and processed off-chain. The entire batch is then posted to Ethereum as a single transaction, but only the data - not the full computation - is stored. This keeps costs low.

Here’s the catch: no one checks if those transactions are valid right away. Instead, there’s a 7-day window called the challenge period. During that time, anyone can submit a fraud proof if they spot something shady. If they do, the network rolls back the bad transaction and punishes the person who submitted it. This system relies on honest actors watching the chain. If no one challenges, the batch gets finalized.

This design makes optimistic rollups cheap to run. A batch of transactions only needs about 40,000 gwei of gas on Ethereum. That’s why networks like Arbitrum and Optimism can offer fees under $0.10 for simple swaps. But that low cost comes with a trade-off: you can’t withdraw your funds for a full week. If you’re trying to move money out of a Layer 2 to pay bills or buy something on Ethereum, that delay can be frustrating.

How Zero-Knowledge Rollups Work

Zero-knowledge rollups (zk-rollups) take the opposite approach: prove it’s valid before you even post it. Instead of waiting for someone to catch a mistake, they use advanced math called zero-knowledge proofs to verify every transaction before it goes on-chain.

Think of it like a magic certificate. You don’t show the actual transaction details - you just prove that you followed all the rules. The Ethereum network checks the proof in seconds, and if it’s valid, the transaction is final. No waiting. No challenge period. No risk of fraud slipping through.

This method is more secure, but it’s also way more expensive to generate. Each zk-rollup batch uses around 500,000 gwei of gas - over 12 times more than an optimistic rollup. That means higher costs for the network operators, which can trickle down to users. But for many, the trade-off is worth it: withdrawals are instant. Finality is immediate. And because only the proof (not the full transaction data) is posted to Ethereum, zk-rollups are more efficient with on-chain space.

Speed and Finality: Who Wins?

If you’re in a hurry, zk-rollups win by a landslide. With optimistic rollups, you’re stuck waiting 7 days to withdraw funds. That’s not a bug - it’s a feature of how fraud proofs work. But in real life, waiting a week to access your money is a dealbreaker for many users. DeFi traders, NFT buyers, and gamers don’t want to wait. They want to move fast.

Zero-knowledge rollups solve this. Once the proof is verified, the transaction is final. No delays. No uncertainty. That’s why zk-rollups are popular in applications where speed matters - like gaming, payments, and high-frequency trading.

But speed isn’t the only factor. If you’re just holding tokens or doing occasional swaps, a 7-day wait might not matter. What matters more is cost.

Cost Comparison: Gas Fees and Operational Load

Running a blockchain isn’t free. Every byte of data you post to Ethereum costs money. Optimistic rollups post full transaction data - all the inputs, outputs, and signatures. That’s a lot of data. But they don’t do heavy math. So gas fees stay low.

Zk-rollups post almost no data - just a tiny proof. That saves space. But generating that proof? It takes serious computing power. You need specialized hardware, advanced software, and lots of electricity. That drives up operational costs. Even though the on-chain cost is lower, the off-chain cost is higher.

Here’s the real-world impact: if you’re running a decentralized exchange on an optimistic rollup, you can offer near-zero fees. On a zk-rollup, you might need to charge a little more just to cover the cost of generating proofs. That’s why most low-cost DeFi apps still run on Arbitrum or Optimism.

Security: Trust vs Math

Security is where the two really split apart.

Optimistic rollups depend on people. Someone has to watch the chain, spot fraud, and submit a proof. If no one does - or if the network is too small - bad actors could slip through. That’s why most optimistic rollups rely on a small group of validators or a decentralized network of watchers. It’s not foolproof, but it’s worked so far.

Zk-rollups don’t need watchers. They use math. Once the proof is verified, the transaction is 100% valid. No human intervention. No guesswork. That’s why experts like Vitalik Buterin believe zk-rollups will win long-term. Math doesn’t get lazy. It doesn’t go offline. It doesn’t get bribed.

But here’s the catch: zk-proofs are hard to build. If the software has a bug, the whole system could be compromised. Optimistic rollups are simpler - easier to audit, easier to fix. That’s why they’re more mature today.

Adoption and Real-World Use

Right now, optimistic rollups dominate. Arbitrum and Optimism together hold over $10 billion in locked value. Why? Because they were first. They’re easier to build on. Developers love them. The tools are mature. The OP Stack lets anyone launch their own rollup in days.

Zk-rollups are catching up fast. Starknet, zkSync, and Polygon zkEVM are all gaining traction. They’re better for apps that need speed and privacy - like decentralized identity, private payments, and gaming. But they’re still harder to develop for. Fewer tools. Fewer developers. Higher costs.

Here’s what’s changing: zk-proofs are getting faster. New hardware is making proof generation cheaper. Tools like Cairo and zk-SNARKs are becoming easier to use. In the next 1-2 years, zk-rollups could overtake optimistic ones in adoption - especially as Ethereum’s base layer gets more crowded.

Which One Should You Use?

It depends on what you need.

If you’re a developer building a DeFi app and want low fees and fast deployment, go with an optimistic rollup. You’ll save time, money, and headaches.

If you’re building a payment app, a gaming platform, or something that needs instant finality and privacy, zk-rollups are the better choice. You’ll pay more upfront, but your users will thank you.

For everyday users? If you’re swapping tokens or holding ETH, either works. But if you need to withdraw quickly - say, to pay rent or buy a car - go with a zk-rollup. No waiting.

The future isn’t one or the other. It’s both. Optimistic rollups will keep growing. Zk-rollups will keep improving. Ethereum doesn’t need just one solution. It needs a toolbox. And right now, both tools are essential.

Are optimistic rollups safer than zero-knowledge rollups?

No, zero-knowledge rollups are mathematically more secure. Optimistic rollups rely on people spotting fraud, which introduces risk if no one is watching. Zk-rollups use cryptographic proofs that are verified automatically - no human input needed. But optimistic rollups are simpler to audit and fix if something goes wrong.

Why do optimistic rollups have a 7-day withdrawal period?

It’s the challenge period. Since optimistic rollups don’t verify transactions before posting, they need time for someone to submit a fraud proof if a transaction is invalid. If no one challenges within 7 days, the batch is considered final. This delay ensures security but slows down withdrawals.

Do zero-knowledge rollups cost more to use?

Sometimes. Generating zero-knowledge proofs requires powerful hardware and complex software, which raises operational costs. That can lead to slightly higher fees for users. But because zk-rollups post less data to Ethereum, their on-chain fees are lower. The total cost depends on the network - some zk-rollups have already optimized fees to be competitive.

Can I switch from an optimistic rollup to a zk-rollup?

Yes - but not directly. You can withdraw your funds from an optimistic rollup back to Ethereum, then deposit them into a zk-rollup. There’s no seamless bridge between the two systems yet. Each rollup runs its own smart contracts, so you need to move assets through Ethereum’s main chain first.

Will zero-knowledge rollups replace optimistic rollups?

Not soon. Optimistic rollups are simpler, cheaper to operate, and have a huge head start in adoption. But as zk-proof technology improves and becomes cheaper to generate, zk-rollups will likely take over for applications that need speed, privacy, and finality. The future is likely a mix - both will coexist, serving different needs.

Write a comment