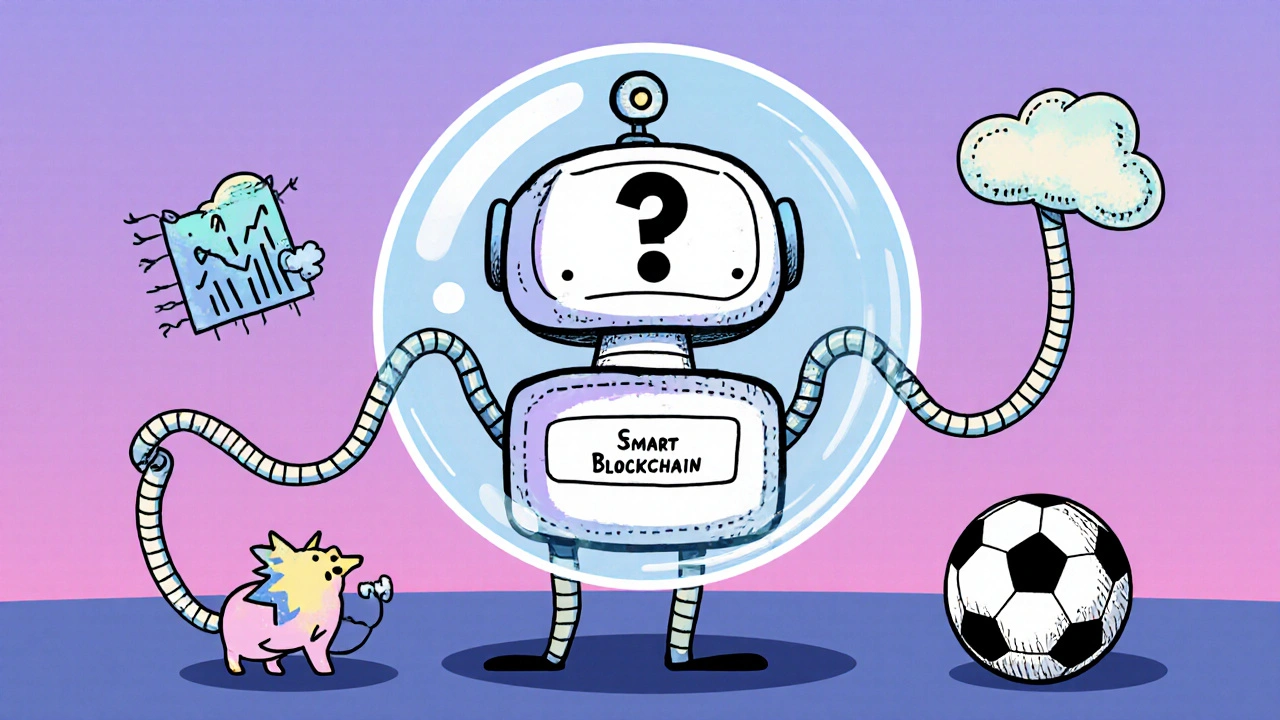

Smart contracts on blockchains like Ethereum can’t just reach out and check the weather, stock prices, or the outcome of a soccer match. They live in a closed system-no internet, no real-world data. That’s the oracle problem. Without trustworthy outside information, smart contracts are useless for real-world applications like insurance payouts, loan approvals, or supply chain tracking. Decentralized oracles fix this. They bring reliable, tamper-proof data from the real world into blockchains without creating a single point of failure.

Why smart contracts need real-world data

Imagine a crop insurance smart contract that pays farmers automatically when rainfall drops below 2 inches in a month. It sounds simple. But how does the blockchain know the actual rainfall? It can’t. It doesn’t have sensors. It doesn’t have access to weather stations. If you plug in a single data source-say, a private weather API-then that company controls the outcome. They could lie, get hacked, or go offline. The contract fails. That’s not automation. That’s risk. This isn’t theoretical. In 2023, a DeFi lending platform lost $47 million because a centralized oracle reported a fake price for a token. The blockchain believed it. The contract executed. The damage was done. Decentralized oracles prevent this by gathering data from multiple independent sources and cross-verifying it before feeding it to the blockchain.How decentralized oracles work

Decentralized oracles operate like a jury. Instead of one witness giving testimony, dozens of independent nodes report the same piece of data-like the current price of Bitcoin or the temperature in Chicago. These nodes are run by different people, in different locations, using different data feeds. They submit their answers. The system then takes the median value, discards outliers, and only sends the consensus result to the smart contract. For example, Chainlink, the most widely used decentralized oracle network, pulls price data from over 90 exchanges and data providers. Each node fetches the price independently. If one node says Bitcoin is $62,000 and the rest say $62,500, the system ignores the outlier. The contract only sees $62,500. No single entity controls the data. No single point can be hacked or manipulated. This isn’t just about price feeds. Decentralized oracles now handle weather data, sports results, flight delays, and even IoT sensor readings from shipping containers. They’re built to be permissionless-anyone can run a node. And they’re incentivized: nodes earn crypto tokens for accurate reporting and lose them for bad data.The difference between centralized and decentralized oracles

| Feature | Centralized Oracle | Decentralized Oracle |

|---|---|---|

| Data Sources | One provider (e.g., Bloomberg API) | Multiple independent sources |

| Failure Risk | High-single point of failure | Low-no single point of failure |

| Manipulation Risk | High-provider can lie or be hacked | Very low-requires consensus |

| Transparency | Opaque-users trust the provider | Open-data provenance visible on-chain |

| Incentives | None-provider has no skin in the game | Yes-nodes stake crypto and earn rewards |

Centralized oracles are like trusting a single bank teller with your entire savings. Decentralized oracles are like having 20 bank tellers, each counting the cash separately, and only accepting the result if 16 agree. The system doesn’t need to trust any one person. It trusts the math.

Real-world use cases

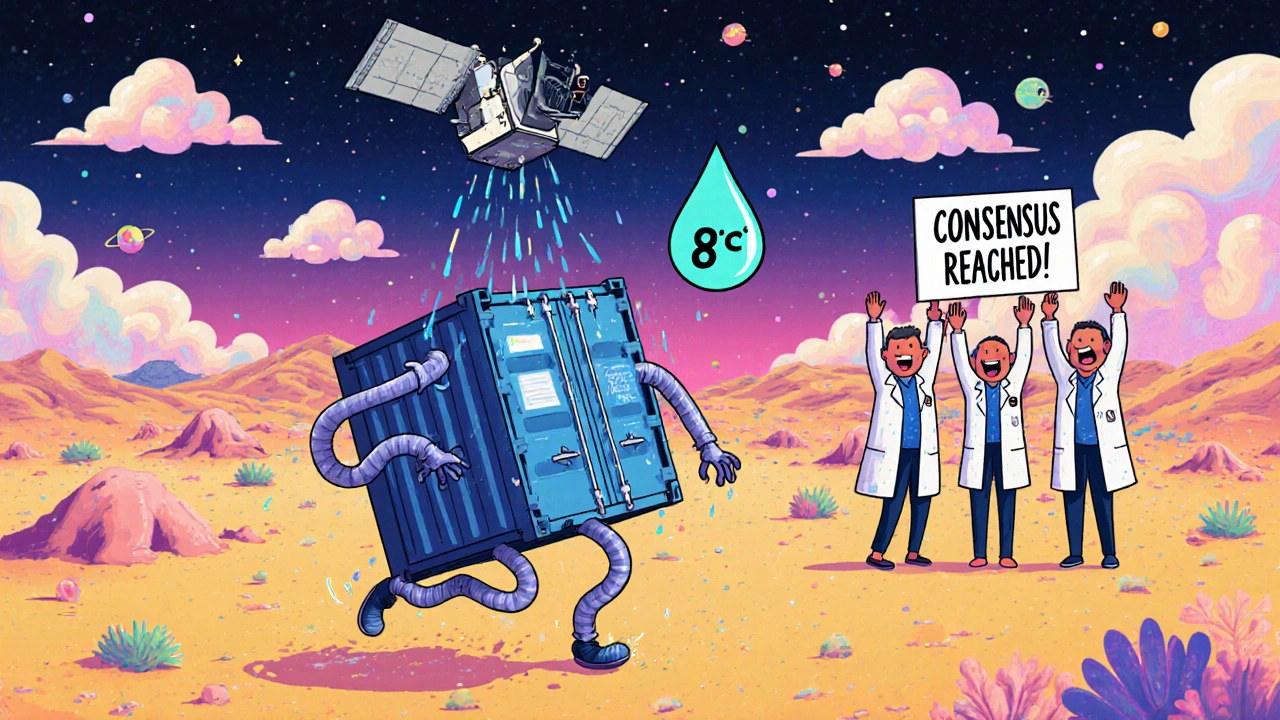

Decentralized oracles aren’t just for crypto traders. They’re enabling real business applications. In insurance, companies like Etherisc use oracles to automatically pay out flight delay claims. If a flight is delayed over two hours, the oracle checks official airline data, confirms it on-chain, and triggers a payout. No paperwork. No claims process. Just code. In supply chains, Maersk and IBM’s TradeLens platform uses oracles to track container locations and temperatures. If a shipment of medicine goes above 8°C for more than 30 minutes, the system flags it and notifies the recipient. That’s not just convenience-it’s compliance and safety. Even sports betting platforms now use decentralized oracles to determine winners. Instead of relying on a single sports data provider, they pull results from multiple official APIs and verify them through a network of nodes. No one can rig the outcome.What happens if an oracle fails?

No system is perfect. But decentralized oracles are designed to fail safely. If one node goes offline or reports bad data, it’s ignored. If multiple nodes start acting suspiciously, the network detects the pattern and penalizes them by slashing their staked tokens. The smart contract only executes when enough honest nodes agree. This is called consensus-based validation. Some networks even use reputation systems. Nodes with a long history of accurate reporting get priority access to high-value data requests and earn higher rewards. Bad actors get shut out. In 2024, a major DeFi protocol suffered a brief outage when a third-party data feed went down. But because the oracle used 12 independent sources, only one failed. The contract paused-not because of fraud, but because the system detected insufficient consensus. That’s a feature, not a bug. It’s safer than blindly trusting one source.

How to choose a decentralized oracle

Not all decentralized oracles are the same. Here’s what to look for:- Number of data sources-More sources mean more reliability. Chainlink uses 90+. Look for networks that don’t rely on just a few.

- Node diversity-Are nodes run by individuals, companies, or institutions? The more geographically and organizationally diverse, the better.

- Staking requirements-Nodes that stake real value have more to lose if they lie. Avoid networks with no token staking.

- Transparency-Can you see the data flow? Can you verify the source? Open-source code and on-chain logs are a must.

- Track record-Has the network been live for over a year? Has it ever been compromised? Chainlink has operated since 2019 with zero successful attacks on its oracle layer.

Most enterprise projects today use Chainlink because it’s battle-tested, open, and integrates with nearly every major blockchain. But alternatives like Band Protocol, API3, and Pyth Network are gaining ground, especially in niche areas like real-time market data or IoT feeds.

The future of decentralized oracles

By 2026, over 70% of DeFi protocols will rely on decentralized oracles for critical functions, according to a 2025 report from Delphi Digital. But the real growth is outside crypto. Insurance, logistics, energy grids, and even government services are testing oracle-based automation. Imagine a carbon credit system where satellites verify deforestation rates and automatically issue credits to landowners. Or a pension fund that pays out based on real-time inflation data pulled from national statistics offices. The key is trust. Blockchains offer transparency and immutability. But without reliable data, they’re just locked ledgers. Decentralized oracles unlock the potential. They turn code into real-world action-fairly, securely, and automatically.It’s not magic. It’s math. It’s incentives. It’s distributed truth.

What is the oracle problem in blockchain?

The oracle problem is the challenge of getting real-world data-like prices, weather, or sports results-into a blockchain. Blockchains are isolated systems and can’t access outside information on their own. If you rely on a single data source, you create a vulnerability. That’s the problem decentralized oracles solve by using multiple, independent sources to verify data before it enters the blockchain.

Are decentralized oracles completely hack-proof?

No system is 100% hack-proof, but decentralized oracles are designed to make attacks extremely difficult and costly. An attacker would need to compromise a majority of independent nodes or data sources simultaneously-which is far harder than hacking one API. In practice, no major decentralized oracle network has been successfully compromised at the data level since 2019.

Can I run my own decentralized oracle node?

Yes, if you have the technical setup and are willing to stake cryptocurrency. Networks like Chainlink allow anyone to become a node operator. You need a reliable server, consistent internet, and a minimum amount of crypto (like LINK tokens) as collateral. If you report accurate data, you earn rewards. If you lie or go offline, you lose part of your stake.

Do decentralized oracles work on all blockchains?

Most major decentralized oracles, like Chainlink, support Ethereum, Binance Smart Chain, Polygon, Solana, and others. They use cross-chain communication protocols to deliver data across different networks. However, smaller blockchains may not have native oracle support yet. Always check if the oracle network you’re using is compatible with your blockchain.

Why not just use APIs instead of decentralized oracles?

APIs are centralized. If the company behind the API goes down, gets hacked, or changes its terms, your smart contract breaks. Decentralized oracles eliminate this risk by combining data from multiple APIs and independent sources. They don’t just fetch data-they verify it. That’s the difference between a single phone call and 20 people confirming the same fact.

Rajat Patil

8 Nov 2025 at 15:26This is one of the clearest explanations I've read on oracles. I work in rural India where farmers rely on weather patterns, and the idea of automated insurance payouts based on rainfall data feels like a quiet revolution. No more waiting months for claims. No more middlemen taking cuts. Just code doing what it should. Thank you for making this real.