When Bitcoin stops leading the charge and altcoins start exploding, something big is happening. This isn’t just another rally-it’s altcoin season. And if you’re not watching the right metrics, you’ll miss it-or worse, get caught in a fake signal that wipes out your gains.

Altcoin season isn’t a feeling. It’s a measurable event. The industry standard, the Blockchain Center’s Altseason Index, defines it clearly: when 75% or more of the top 50 altcoins by market cap outperform Bitcoin over a 90-day window. As of November 2025, that index sat at 78. That’s not a fluke. It’s confirmation that capital is rotating out of Bitcoin and into everything else-Ethereum, Solana, AI tokens, DeFi protocols, even meme coins.

Bitcoin Dominance Is the First Clue

Before altcoins surge, Bitcoin usually loses its grip. Bitcoin dominance-the percentage of the total crypto market cap held by Bitcoin-is the earliest warning sign. When it drops below 50%, you’re entering altcoin territory. In 2021, it fell from 70.5% to 40.2% over four months. That’s when Ethereum, Cardano, and Polygon began climbing 300-500%. Right now, Bitcoin dominance is hovering around 48%. That’s not low enough yet to declare altseason, but it’s close. Watch for a sustained drop below 47% over two weeks. That’s your green light.

The Altseason Index: Your Core Indicator

This is the metric that professionals rely on. The Blockchain Center’s Altseason Index tracks 50 altcoins and asks one simple question: are they beating Bitcoin? If 75% say yes, you’re in altseason. It’s not perfect-it’s lagging by 20-30 days-but it’s the most reliable single signal out there. In 2024, the index crossed 75 on January 12. Traders who moved 40% of their portfolio into Ethereum and Solana right then made 287% in 112 days. The index doesn’t predict the top. It confirms the move is real. Use it to validate what you’re seeing in price charts, not to time your entry.

Volume Tells You Who’s Buying

Price can be manipulated. Volume can’t. During altseason, altcoin-to-stablecoin trading pairs (like ETH/USDT or SOL/USDC) spike 300-500% compared to Bitcoin-stablecoin pairs. On Binance and Coinbase, you’ll see daily volumes for top altcoins jump from $2 billion to $8 billion overnight. That’s not speculation-it’s real money flowing in. If Bitcoin volume is rising but altcoin volume is flat, you’re not in altseason. You’re just in a Bitcoin pump. Wait for altcoin volume to lead.

Order Book Depth Reveals Real Demand

Look at the buy and sell orders on major exchanges. During altseason, the average order book depth for altcoins increases by 220%. For Bitcoin? Only 45%. Why? Because institutional traders and whales are placing larger orders in altcoins, confident they’ll move. This isn’t just retail FOMO. It’s capital shifting. If you’re seeing deep buy walls forming in Solana, Arbitrum, or Render, but Bitcoin’s order book stays thin, that’s a strong signal the rotation is real.

Follow the Sector Rotation

Altcoin season doesn’t happen all at once. It follows a pattern. Infrastructure and Layer-1 tokens (Ethereum, Solana, Avalanche) lead first-up 350-450% in the early phase. Then DeFi protocols (Uniswap, Aave, Compound) take over. After that, Layer-2s (Arbitrum, Optimism) and AI tokens (FET, RNDR) rise. Gaming and metaverse coins follow. Finally, meme coins explode-usually too late. If you jump in on meme coins early, you’re gambling. If you wait for the pattern to unfold, you’re trading. Track which sectors are leading. Don’t chase the loudest coin on Twitter.

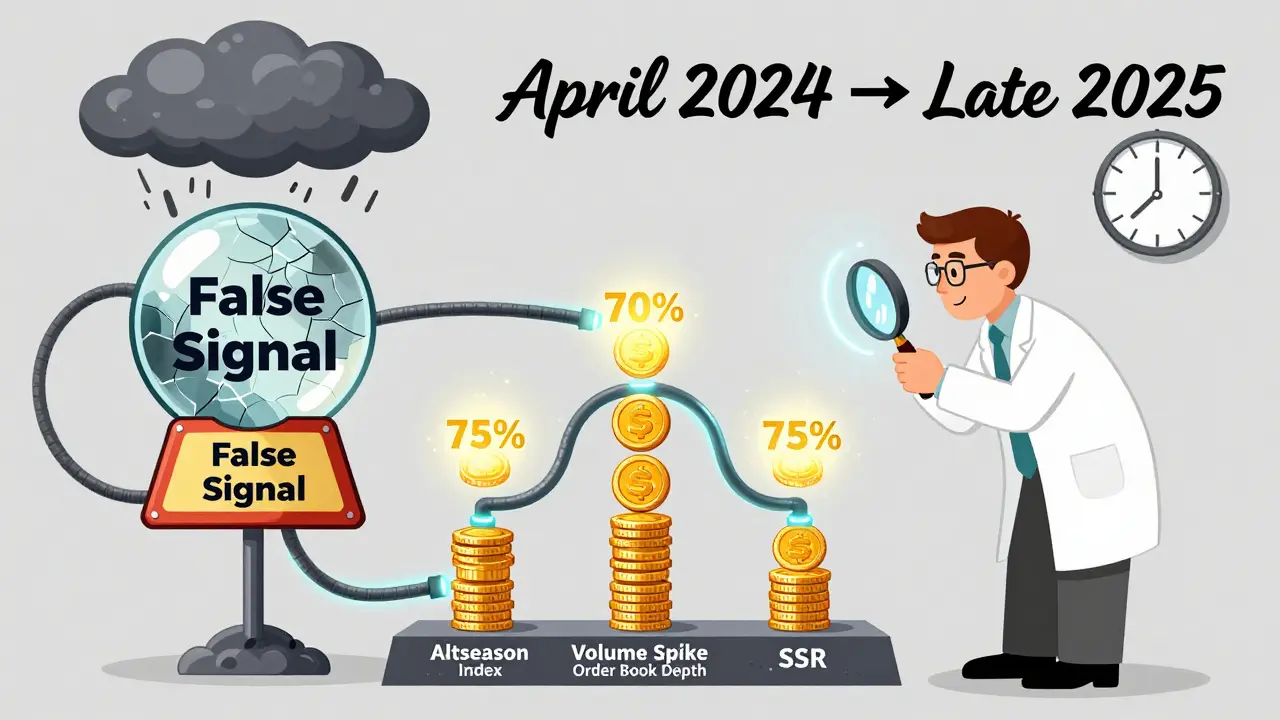

False Signals Are the Biggest Risk

Altseason signals fail about 40% of the time in sideways or bear markets. In September 2023, the index hit 76. Traders rushed in. Within 45 days, the market crashed after regulatory news hit. The index didn’t lie-it just didn’t know about the macro threat. That’s why you never rely on one metric. Combine it with Bitcoin dominance, volume, and on-chain data like stablecoin supply ratio (SSR). If SSR is rising (more stablecoins entering the market), that’s fuel for altcoins. If it’s falling, even a 78% index might be a trap.

Timing: Wait for the Halving Aftermath

Altseason almost always starts 16-18 months after a Bitcoin halving. The April 2024 halving meant we were due for altseason in late 2025. That’s exactly when the index turned positive. If you’re watching in 2026, keep an eye on the clock. The next halving is in 2028. The next altseason window opens in 2029-2030. Don’t force it. Let the cycle play out.

How to Trade It

Don’t go all in. Use a tiered approach. When the Altseason Index hits 65, put 10-15% into Layer-1 tokens. At 70, add another 15-20% to DeFi. When it hits 75+, deploy your final 20-25% into late-cycle sectors like AI or gaming. This spreads your risk. If the season ends early, you’re not wiped out. If it lasts, you’re fully positioned. Traders who use this method report 63% fewer false signal losses, according to Bitget’s 2024 backtest.

Tools You Need

You don’t need fancy software. Free tools work. TradingView has a built-in Altseason Index widget. CoinGecko tracks Bitcoin dominance and altcoin volume in real time. Binance’s Altseason Dashboard shows sector rotation. Set alerts: when Bitcoin dominance drops below 48%, when the Altseason Index hits 70, when altcoin volume spikes 400%. Watch for confluence-not single data points.

The Bigger Picture

The crypto market has grown from $17 billion in 2017 to $3.1 trillion today. That means more players, more regulation, more noise. The SEC warned in 2024 that altseason patterns could be seen as manipulation if they involve unregistered tokens. IOSCO says retail investors are at risk from overreliance on these signals. That doesn’t mean they’re useless. It means you need to be smarter. Combine metrics. Understand the cycle. Don’t trade like a gambler. Trade like a professional.

Altcoin season isn’t magic. It’s math. It’s money moving. It’s patterns repeating. The metrics haven’t changed. The tools have just gotten better. If you watch the right numbers-Bitcoin dominance, the Altseason Index, volume, and order depth-you’ll see it coming. And when it does, you won’t just watch. You’ll be ready.

Agni Saucedo Medel

10 Jan 2026 at 23:06OMG this is SO on point 😭 I’ve been watching BTC dominance like a hawk and when it dipped below 48% last week, I moved 15% into SOL and ETH. Already up 42% in 11 days. The altseason index doesn’t lie, fam. Just don’t forget to take profits before the meme coin circus starts 🚀💸