Imagine sending a payment through a digital system that’s as secure as a vault, run by thousands of strangers around the world, and still finishes in under a second. Sounds perfect, right? But here’s the catch: blockchain scalability doesn’t work that way-not yet, anyway. Every major blockchain today faces a tough choice between three things: being decentralized, being secure, or being fast. You can pick two. Not all three. This is called the blockchain trilemma, and it’s the reason why your crypto transactions sometimes cost $50 in fees or why some networks crash when they get popular.

What Exactly Is the Blockchain Trilemma?

The blockchain trilemma isn’t a bug-it’s a design limit. It was first clearly explained by Ethereum co-founder Vitalik Buterin back in 2017. At its core, it says that any blockchain can only truly deliver two of these three qualities at once:- Decentralization: No single company or person controls the network. Thousands of regular people run nodes that verify transactions.

- Security: The network can’t be hacked, tampered with, or shut down easily. It resists attacks from bad actors.

- Scalability: The system can handle lots of transactions quickly and cheaply-like Visa processing 24,000 payments per second.

Why can’t you have all three? Because they fight each other. More decentralization means more computers need to agree on every transaction, which slows things down. More speed often means fewer computers validating transactions, which makes the system more vulnerable. And if you make it super secure with heavy cryptography and consensus checks, it becomes too slow for everyday use.

How Bitcoin Handles the Trilemma

Bitcoin is the original blockchain-and it chose decentralization and security over speed. It’s still running strong after 15 years, with over 15,000 independent nodes spread across the globe. Every transaction is checked by many of these nodes using a proof-of-work system that burns massive amounts of electricity-around 110 terawatt-hours a year. That’s more than some countries use. In return, Bitcoin has never been hacked at the protocol level.But here’s the downside: Bitcoin can only process about 7 transactions per second. During peak times, like in late 2017, fees spiked to $55 per transaction, and waits stretched past two hours. That’s fine if you’re moving $10,000. Not so great if you’re buying coffee. Bitcoin’s design prioritizes safety and openness, even when it’s inconvenient.

Ethereum: Trying to Have It All

Ethereum took a different path. It started like Bitcoin-slow, secure, and decentralized-but quickly became the hub for decentralized apps, NFTs, and DeFi. By 2021, it was drowning in traffic. Gas fees hit $100+ during NFT drops. Users were furious.In September 2022, Ethereum switched from proof-of-work to proof-of-stake. This cut its energy use by 99.95% and made it more efficient. It still has over 800,000 validators-more than any other public blockchain. Security? Still rock solid. Decentralization? Still strong. But scalability? Only slightly better: 15-30 transactions per second. Still nowhere near Visa.

So Ethereum’s answer wasn’t to fix itself alone. It outsourced speed to Layer 2 networks like Arbitrum and Optimism. These are secondary systems that bundle hundreds of transactions off-chain and then post one summary to Ethereum’s main chain. That way, Ethereum stays secure and decentralized, while Layer 2s handle the heavy lifting. Today, over half of all Ethereum transactions happen on these Layer 2s. It’s not a perfect fix, but it’s the best trade-off so far.

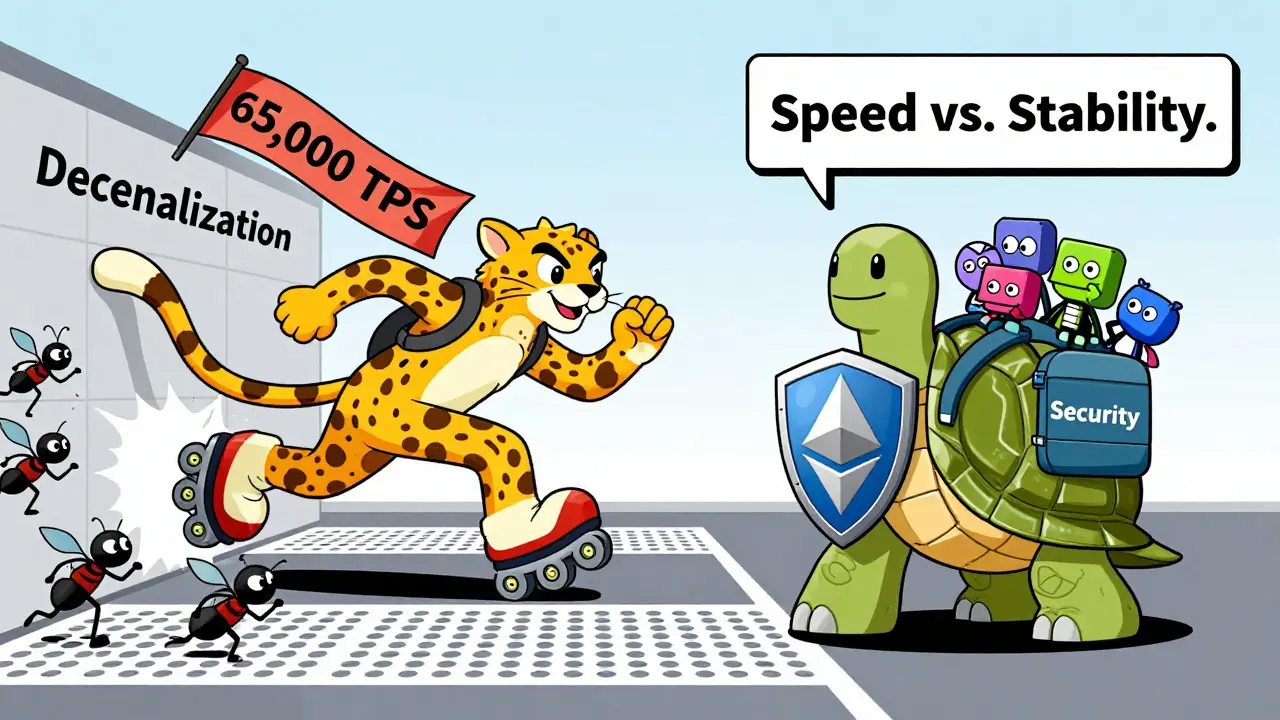

Solana: Speed at a Cost

Then there’s Solana. It promises 65,000 transactions per second-and sometimes hits 3,000 in real use. Fees are pennies. It’s popular for NFTs and DeFi apps because it feels fast and cheap.But here’s the catch: Solana’s network went down six times in 2022, totaling nearly 20 hours of downtime. Why? Because its design relies on powerful, expensive hardware to keep up with the speed. Only about 2,000 validators run nodes. Compare that to Ethereum’s 800,000. That’s not decentralization-that’s a small club of well-funded operators.

Users love the speed until the network crashes during a big NFT launch. Then they lose money. Reddit threads are full of stories like: “Lost $300 because Solana went down for 8 hours.” Solana’s team says the trilemma can be beaten. But so far, the evidence says otherwise: high speed came at the cost of reliability and decentralization.

Other Players and Their Trade-Offs

Cardano tries to balance all three with a proof-of-stake system that’s slow but energy-efficient. It handles about 250 TPS with 3,500 validators. Not bad, but not groundbreaking.Polygon’s sidechain hits 7,000 TPS, but only 100 validators control it. That’s scalable and secure-but not decentralized at all. It’s more like a private network with a public face.

Ripple (XRP) processes 1,500 TPS with just 150 validators. Over 70% of them are controlled by Ripple Labs. That’s fast, but it’s not a blockchain in the true sense-it’s a centralized database with blockchain branding.

Even Bitcoin Cash tried to solve scalability by increasing block size to 32MB. It jumped to 100 TPS-but the number of full nodes dropped from 15,000 to under 500. Fewer nodes mean less decentralization and more risk of central control.

Layer 1 vs Layer 2: The Two Paths Forward

There are two main ways to tackle the trilemma: change the base blockchain (Layer 1) or build on top of it (Layer 2).Layer 1 changes mean altering the core protocol. Examples:

- Sharding (Ethereum’s future plan): Split the network into 64 smaller chains, each handling its own transactions. Could push throughput to 100,000 TPS.

- Alternative consensus (Avalanche): Uses a faster, novel method to reach agreement. Handles 4,500 TPS with over 1,000 validators.

- Bigger blocks (Bitcoin Cash): Increases data per block. Boosts speed but reduces node count.

These changes are hard. They require network-wide upgrades, consensus among users, and carry risks of forks or instability.

Layer 2 solutions are simpler and safer:

- Rollups (Arbitrum, Optimism): Bundle many transactions off-chain, then prove their validity on Ethereum. Get 5,000+ TPS with Ethereum’s security.

- State channels (Lightning Network): Open a private channel between two users to make dozens of payments without touching the main chain. Theoretically handles over a million TPS.

- Sidechains (Polygon PoS): Separate blockchains connected to Ethereum. Faster and cheaper, but less secure than the main chain.

Layer 2s are winning because they don’t force users to choose between speed and safety. They let Ethereum stay true to its values while letting users enjoy fast, cheap transactions.

What This Means for You

If you’re using crypto for everyday payments, you’re probably already on a Layer 2. You might not even realize it. MetaMask users often send transactions through Optimism or Arbitrum without knowing the difference.If you’re building an app, you’ll face the trilemma too. Do you want low fees and fast users? Go with Solana or Polygon-but be ready for outages or centralization backlash. Do you want trust and longevity? Stick with Ethereum and Layer 2s, even if fees spike once in a while.

Enterprise companies? Most of them avoid public blockchains entirely. They use private networks like Hyperledger. Why? Because they need speed and security-but they don’t care about decentralization. They’re not trying to build the next Bitcoin. They’re trying to track supply chains or automate contracts. For them, the trilemma doesn’t matter. They pick two: speed and security-and skip decentralization entirely.

The Future: Can the Trilemma Be Solved?

Some developers say yes. Solana’s founders claim they cracked it. Others say it’s like trying to build a car that’s fast, safe, and fuel-efficient without any engine improvements-possible in theory, but nearly impossible in practice.Right now, the industry’s answer is: don’t try to solve it on one chain. Solve it across layers. Ethereum handles security and decentralization. Layer 2s handle speed. New chains like Berachain and zkSync are experimenting with zero-knowledge proofs to bring even more security to fast networks.

But here’s the real truth: the trilemma isn’t going away. It’s not a glitch to fix. It’s a law of engineering. Every blockchain will make trade-offs. The smart ones just make them openly, honestly, and with clear communication.

So next time you see a blockchain promising “unlimited speed, total decentralization, and bank-level security,” ask yourself: which two are they giving you? And which one are they hiding?

What’s Next for Blockchain?

The next five years will be about integration, not competition. Ethereum won’t beat Solana. Solana won’t replace Bitcoin. Instead, we’ll see chains working together. Bitcoin as digital gold. Ethereum as the secure backbone. Solana and others as high-speed lanes for specific use cases. Layer 2s will become invisible infrastructure-like highways beneath your phone screen.Regulations are also pushing the needle. The EU’s MiCA law, effective in 2024, requires stricter node distribution for certain tokens. That means projects aiming for compliance will have to become more decentralized-even if it slows them down.

And developers? They’re learning to design for trade-offs. A 2023 survey found 68% of blockchain devs say balancing the trilemma is their biggest challenge. That’s not a failure. It’s maturity. We’re moving past hype into real engineering.

Can a blockchain ever have full decentralization, security, and scalability at the same time?

No-not with current technology. Every major blockchain today makes trade-offs. Bitcoin sacrifices speed for decentralization and security. Solana sacrifices decentralization for speed. Ethereum uses Layer 2s to get speed without giving up its core values. While new ideas like zero-knowledge proofs and sharding help, they don’t eliminate the trilemma. They just shift where the trade-offs happen.

Why do Ethereum gas fees still spike even after the Merge?

The Merge switched Ethereum from proof-of-work to proof-of-stake, which made it more energy-efficient and slightly faster-but it didn’t increase transaction capacity. The base layer still only handles 15-30 transactions per second. When demand spikes-like during an NFT drop or a popular DeFi launch-users bid up fees to get their transactions processed first. Layer 2s like Arbitrum and Optimism now handle over half of Ethereum’s traffic to reduce this pressure.

Is Solana really faster than Ethereum, or is it just marketing?

Solana is technically faster-it’s designed for speed. But real-world performance is different. Solana’s theoretical max is 65,000 TPS, but it usually runs around 2,000-3,000 TPS under normal conditions. Ethereum runs 15-30 TPS on its main chain, but with Layer 2s, effective throughput exceeds 5,000 TPS. More importantly, Solana has had multiple outages, while Ethereum’s main chain has never gone down. Speed means nothing if the network crashes when you need it most.

Why do some blockchains have so few validators?

Fewer validators usually mean higher speed and lower costs-but less decentralization. Solana requires expensive hardware to run a node, so only well-funded operators can participate. Ripple uses only 150 validators, 110 of which are controlled by the company itself. These designs prioritize performance and control over openness. They’re not “public blockchains” in the Bitcoin sense-they’re more like fast private networks with public-facing interfaces.

Should I use Ethereum or Solana for my next crypto project?

If you need trust, long-term stability, and access to the biggest DeFi and NFT ecosystems, use Ethereum with a Layer 2 like Arbitrum or Optimism. If you’re building something that needs ultra-fast, low-cost transactions and can tolerate occasional outages-like a gaming app or high-frequency NFT mint-Solana might be better. But know the risks: Solana’s centralization and downtime are real. Ethereum’s ecosystem is bigger, safer, and more resilient, even if it’s slower.

Nicholas Zeitler

15 Jan 2026 at 09:32Okay, so let me get this straight: you’re telling me that Bitcoin’s like that one friend who shows up to every party with a thermos of coffee and refuses to dance-but you know they’ll protect you if someone tries to start a fight? And Ethereum’s the one who threw a party last year and now everyone’s using their backyard for everything, even though the Wi-Fi still glitches when too many people stream TikTok at once? I mean, I get it-Layer 2s are like renting a second house just so you can have a BBQ without burning down the main one. Honestly? I’m just glad someone finally admitted we’re not building a utopia-we’re building a messy, beautiful, slightly broken house with too many extensions.