Imagine borrowing $10 million without putting up a single dollar as collateral. No credit check. No bank approval. No waiting weeks. Just a few seconds on the blockchain, and the money is yours - if you pay it back before the transaction ends. This isn’t science fiction. It’s flash loans, a groundbreaking feature of decentralized finance (DeFi) that turns traditional lending on its head.

What Exactly Is a Flash Loan?

A flash loan is a type of uncollateralized loan that exists only within a single blockchain transaction. You borrow funds - say, 10,000 DAI or 50 ETH - and you must return them, plus a small fee, before the transaction finishes. If you don’t repay, the entire transaction is reversed. It’s like a magic trick: the money appears, you use it, and then it vanishes - back to where it came from - with no trace left behind.This only works because of how blockchains handle transactions. Every transaction is either fully completed or completely undone. There’s no middle ground. Flash loans exploit this atomicity. They don’t rely on trust or credit scores. They rely on code. And that code must execute perfectly - or everything fails.

Flash loans were first made practical in early 2020 with Aave’s V1 upgrade. Before that, DeFi lending required you to lock up more value than you borrowed - often 150% or even 200%. Flash loans changed that. Now, you can borrow as much as the protocol allows, with zero collateral. The only requirement? You have to pay it back in the same block.

How Flash Loans Work: The Step-by-Step Process

Here’s how a typical flash loan plays out:- Borrow: You deploy a smart contract that requests funds from a DeFi protocol like Aave, Balancer, or dYdX. The protocol sends the requested amount - say, 1 million USDC - directly to your contract.

- Execute: Within the same transaction, your contract does something with that money. This could be buying ETH on one exchange, selling it on another for a higher price, or using it to liquidate an undercollateralized position.

- Repay: Before the transaction ends, your contract must send back the original amount plus a fee (usually 0.09% on Aave). If it can’t, the whole transaction rolls back - like hitting undo on your computer.

That’s it. No bank account. No identity verification. No waiting. Everything happens in under 15 seconds - the average time it takes for an Ethereum block to be mined.

Because flash loans require smart contract coding, they’re almost always used by automated systems - not people clicking buttons. Real humans don’t have the skills or speed to pull this off manually. But bots? They’re perfect for it.

Why Flash Loans Are Powerful

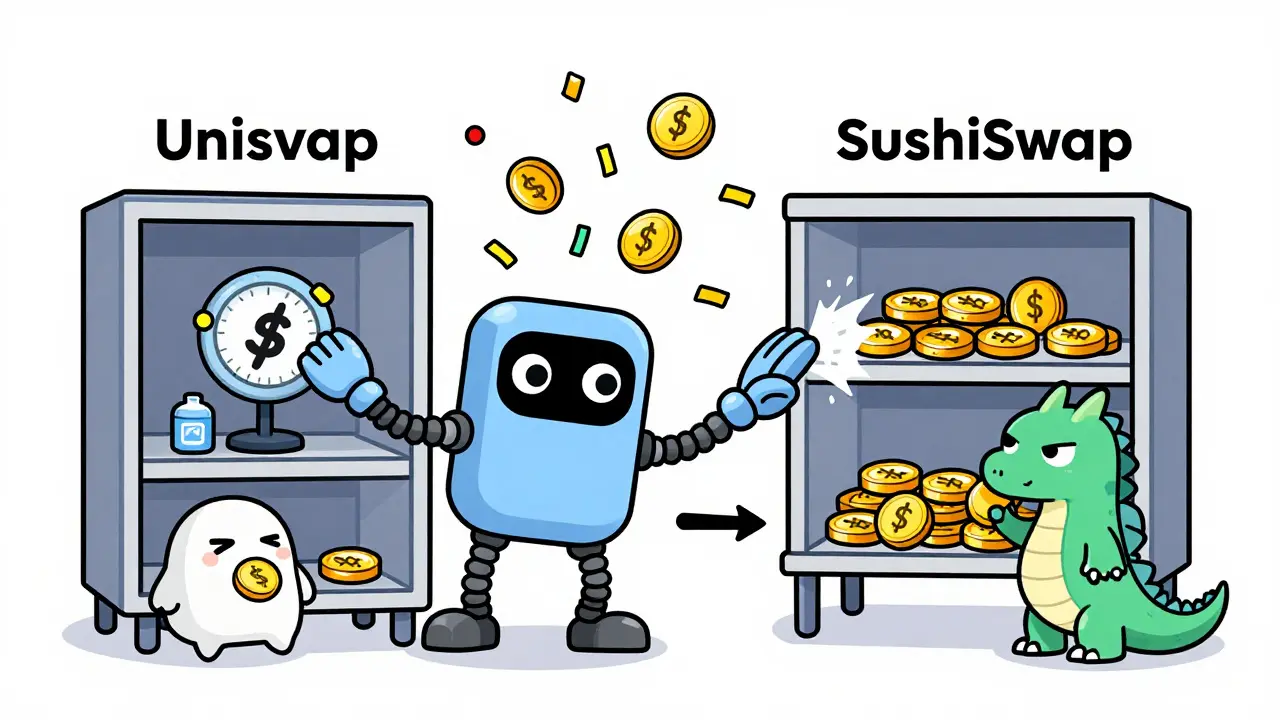

The real power of flash loans isn’t in the borrowing - it’s in what you can do with the borrowed capital.Arbitrage: If ETH is trading at $3,200 on Uniswap and $3,220 on SushiSwap, a bot can borrow 1,000 ETH via flash loan, buy it cheap on Uniswap, sell it expensive on SushiSwap, repay the loan, and pocket the $20,000 profit - all in one transaction. No upfront capital needed. Just speed and smart code.

Collateral Swaps: You can use a flash loan to swap your collateral. Say you have wETH locked in a lending protocol, but you want to switch to DAI. You borrow DAI, use it to repay your existing loan, unlock your wETH, then sell it for more DAI and repay the flash loan. You’ve changed your collateral without ever owning both assets at once.

Liquidations: When someone’s loan becomes undercollateralized, a liquidator can use a flash loan to buy their assets at a discount, repay the original lender, and keep the difference. Flash loans give liquidators the capital they need to act instantly - which keeps the whole system healthy.

According to Aave’s 2022 annual report, over 1.2 million flash loan transactions occurred that year, totaling $15.7 billion. That’s more than all of Balancer’s and dYdX’s combined. And daily volume in late 2023 averaged $478 million - with $430,000 in fees going straight to the protocol.

Flash Loans vs. Traditional Loans

| Feature | Flash Loan | Traditional Bank Loan |

|---|---|---|

| Collateral Required | None | Usually 20-100% |

| Approval Time | Seconds | Days to Weeks |

| Repayment Deadline | Within same transaction (15 sec) | Months to Years |

| Who Uses It | Smart contracts, bots | Individuals, businesses |

| Fee Structure | 0.09% flat fee | Interest rate (3-20%) |

| Regulation | None | Strict (KYC, credit checks) |

Traditional loans are built on trust and oversight. Flash loans are built on code and math. One is slow and safe. The other is fast and risky. Neither is better - they serve completely different purposes.

The Dark Side: Flash Loan Attacks

With great power comes great risk. Flash loans are powerful because they let attackers move huge sums instantly. And that’s exactly what bad actors have done.In October 2020, Harvest Finance lost $24 million when attackers used a flash loan to artificially inflate the price of a token, then drained the protocol’s liquidity pool. In October 2021, Cream Finance was hacked for $114 million using the same trick. Chainlink’s research shows 38 flash loan-related attacks between 2020 and 2023, totaling over $737 million in losses.

The common thread? Price oracles. These are services that tell DeFi protocols what the real price of an asset is. If an attacker uses a flash loan to flood a small exchange with fake trades, they can trick the oracle into reporting a false price. Then they use that false price to borrow more, drain funds, and disappear.

These aren’t random glitches. They’re targeted exploits. And they’ve forced the industry to change.

How the Industry Is Responding

DeFi isn’t ignoring the risks. In fact, it’s adapting fast.Aave launched V3 in late 2023 with a new feature: time-locked flash loans. Instead of requiring repayment in the same block, some loans now allow a two-block window - giving bots a little more time to execute complex strategies while reducing the risk of oracle manipulation.

Protocol developers are also adding circuit breakers. Aave’s governance voted 98.7% in favor of mandatory oracle safeguards that pause trading if price swings exceed a certain threshold. This is like installing a fuse in your electrical system - it won’t stop all fires, but it prevents the whole house from burning down.

Chainlink’s CCIP protocol, launched in Q4 2023, now lets flash loans work across multiple blockchains. That means you can borrow on Ethereum and repay on Polygon - opening up new opportunities and new attack surfaces.

Meanwhile, traditional finance is watching. SEC Chair Gary Gensler called flash loans “high-risk vectors” in March 2023. JPMorgan is exploring private blockchain versions for internal use. But no government has passed rules yet. The space is still wild west.

Who Can Use Flash Loans - And Who Shouldn’t Try

Flash loans aren’t for beginners. You need to understand:- Smart contract development in Solidity (version 0.8.0 or higher)

- Ethereum Virtual Machine (EVM) mechanics

- How DeFi protocols like Aave, Uniswap, and Chainlink interact

- Gas fees - a single flash loan can cost $15 to $200 depending on network congestion

Most successful users are quant funds, DeFi developers, or automated bots. On Reddit, users like “DeFi_Dev_42” have shared profits from $50,000 arbitrage trades with just $500 in gas costs. But others, like “CryptoLoser87,” lost $12,000 in the Hundred Finance attack because they didn’t understand oracle risks.

GitHub has over 1,800 flash loan-related projects. The most popular template - Aave’s flashloan-borrower-template - has been forked over 2,100 times. But 42% of the issues reported are about broken callback functions. That’s the #1 mistake: writing code that doesn’t properly return funds.

If you’re not a developer, don’t try this. If you’re a developer, start small. Test on a forked mainnet. Use Aave’s documentation. Join their Discord (over 14,000 developers are there). And never, ever trust a price feed without double-checking its source.

The Future of Flash Loans

Flash loans are here to stay. They’ve already reshaped DeFi. They’ve made arbitrage faster, liquidations more efficient, and capital more flexible.Consensys predicts flash loan volume will hit $45 billion annually by 2025. MIT’s Digital Currency Initiative warns that without better oracle protections, attack frequency could triple by 2026.

The truth? Flash loans are neutral tools. As Aave’s Head of Security said in 2023: “Their value depends entirely on user intent.”

They can correct market inefficiencies - making prices fairer across exchanges. Or they can drain millions from poorly secured protocols. They’ve been used to build wealth and destroy it. They’ve made DeFi more efficient and more dangerous.

One thing is clear: flash loans didn’t just add a feature to DeFi. They redefined what’s possible in finance. And the world is still catching up.

Can I take out a flash loan as a regular person without coding skills?

No. Flash loans require deploying a smart contract that executes a series of actions within one blockchain transaction. This is not something you can do through a wallet interface like MetaMask. Only developers with Solidity skills and access to blockchain tools can use them. If you’re not a coder, you can’t directly use flash loans.

What happens if I can’t repay a flash loan?

The entire transaction is automatically reversed. No funds are transferred. No debt is created. It’s as if the loan never happened. The blockchain rolls back every step - the borrow, the trade, the repayment attempt - leaving your wallet and the protocol unchanged. There’s no penalty beyond the gas you spent trying.

Are flash loans legal?

Flash loans themselves are not illegal. But how they’re used can be. If you use a flash loan to manipulate prices, steal from a protocol, or exploit vulnerabilities, that’s theft or fraud - and it’s illegal. Regulatory bodies like the SEC have flagged flash loans as high-risk, but no specific laws target them yet. Their legality depends entirely on intent and execution.

Which DeFi protocols offer flash loans?

The three biggest are Aave, Balancer, and dYdX. Aave dominates with over 68% of total volume as of late 2023. Balancer and dYdX offer similar services but with lower usage. Newer platforms like Radiant Capital are entering the space, and cross-chain tools like Chainlink’s CCIP now allow flash loans across multiple EVM-compatible chains.

How much does a flash loan cost?

There’s a flat fee of 0.09% on Aave - so borrowing $1 million costs $900 in fees. But you also pay gas fees to execute the transaction on Ethereum. These vary based on network congestion and complexity. Simple flash loans cost $15-$50. Complex ones involving multiple swaps can cost $100-$200. The total cost is usually less than 1% of the loan amount.

Can flash loans be used on blockchains other than Ethereum?

Yes - but only on EVM-compatible chains like Polygon, Arbitrum, or Binance Smart Chain. Non-EVM chains like Solana or Cosmos don’t support the same transaction atomicity model. However, new cross-chain bridges like Chainlink’s CCIP now allow flash loans to originate on Ethereum and repay on another chain, expanding their reach beyond a single network.

adam smith

16 Dec 2025 at 16:12This is wild. No collateral? Just code? I don’t get how anyone trusts this. I mean, I’ve seen my uncle lose his retirement on NFTs - and this feels like a casino with a PhD.

But hey, if it works, it works. Just don’t ask me to write a smart contract. I can barely set up my Wi-Fi without calling my 12-year-old nephew.