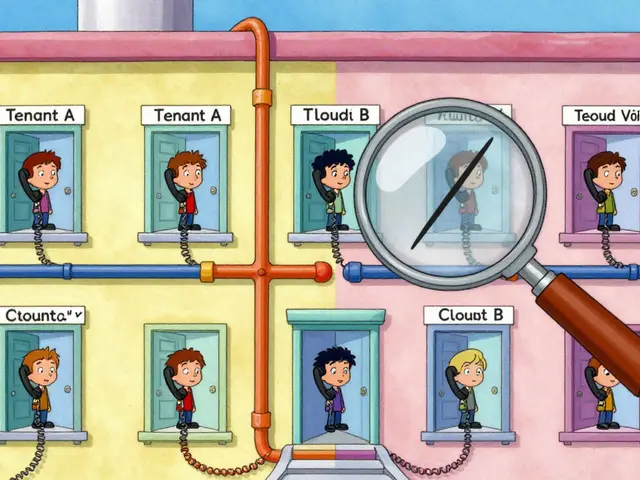

Most blockchains operate in isolation. Bitcoin sends Bitcoin. Ethereum runs Ethereum apps. If you want to move value or data between them, you need bridges-clunky, risky, and often slow. That’s where Polkadot changes the game. It doesn’t just connect blockchains; it lets them talk, share security, and work together like parts of one big machine. No more jumping through hoops. No more trusting third-party bridges. Polkadot’s design lets chains communicate natively, securely, and at high speed.

How Polkadot Works: The Relay Chain and Parachains

Polkadot isn’t one blockchain. It’s a network of blockchains working as one. At the center is the relay chain-the backbone that coordinates everything. Around it are parachains, independent blockchains built for specific uses. One might handle DeFi, another identity verification, another supply chain tracking. Each parachain keeps its own rules, tokens, and speed, but they all get security from the relay chain. That’s the big win: you don’t have to build your own security from scratch. You get it out of the box.

Think of it like a highway system. The relay chain is the central freeway. Parachains are on-ramps and off-ramps that connect to different cities (blockchains). Cars (data, tokens) can move between cities without stopping at toll booths or waiting for manual approvals. Transactions between parachains finalize in about 12 seconds. That’s faster than most Ethereum Layer 2 solutions and way quicker than cross-chain bridges that can take minutes or even hours.

The DOT Token: Governance, Staking, and Bonding

The DOT token isn’t just a currency. It’s the glue that holds Polkadot together. It does three things:

- Governance: DOT holders vote on upgrades, treasury spending, and protocol changes. No central team decides. The community does.

- Staking: You can lock up DOT to help secure the network as a validator or nominator. In return, you earn rewards.

- Bonding: To get a parachain slot, a project must lock up (bond) DOT for a set time. This ensures only serious projects join the network.

There’s a minimum of 1 DOT needed to open an account. But to compete for a parachain slot, projects often need millions. The first auction in 2021 saw Acala Network lock up 70 million DOT-around $1.27 billion at the time. That’s a high barrier, and it’s one reason some critics say Polkadot favors well-funded teams over small startups.

Why Polkadot Beats Other Interoperability Solutions

Other networks like Cosmos also aim for interoperability. But Cosmos uses IBC, where each chain must secure itself. If one chain gets hacked, it’s on its own. Polkadot’s shared security model means a weak parachain still benefits from the strength of the whole network. That’s a major advantage for new projects without big security budgets.

Ethereum’s answer to scaling is Layer 2s like Arbitrum or Optimism. But those still rely on Ethereum’s main chain for finality. Polkadot’s parachains don’t need Ethereum at all. They’re native to the system. Cross-chain communication is built-in, not bolted on.

Deloitte ranked Polkadot as the third most enterprise-ready blockchain in 2022-behind only Ethereum and Hyperledger Fabric. Companies like Microsoft, Deutsche Telekom, and SAP use it for supply chain tracking and digital identity. Why? Because it’s secure, scalable, and designed for real-world business needs.

Technical Details: How Polkadot Handles Transactions

Polkadot uses a consensus system called Nominated Proof-of-Stake (NPoS). Validators secure the relay chain. Nominators choose which validators to back by staking DOT. This spreads trust across many participants instead of concentrating power.

Transactions have three fees:

- Base fee: A flat charge for every transaction.

- Length fee: Based on how big the transaction is in bytes.

- Weight fee: Based on how much computing power it needs.

This system makes fees predictable and fair. You pay for what you use. There’s no gas spike like on Ethereum during peak times. Polkadot’s network handles over 1,000 transactions per second-compared to Bitcoin’s 7 and Ethereum’s 20-30. With the Asynchronous Backing upgrade in Q2 2025, that number could rise to support up to 1,000 parachains, each processing thousands of transactions.

The Developer Experience: Powerful, But Steep

Polkadot’s Substrate framework lets developers build custom blockchains with reusable components. It’s like building with LEGO blocks instead of starting from scratch. Over 112 parachains are live as of late 2025, and developer activity grew 28% year-over-year in 2024.

But it’s not easy. The Web3 Foundation says it takes 80-100 hours of study to become proficient. Beginners often struggle with the shift from monolithic chains to multi-chain thinking. Reddit users praise the documentation (rated 4.5/5 on Stack Overflow) but complain about the complexity. One developer said it took their startup three months just to navigate the crowdloan process to win a parachain slot.

Still, the community is strong. The official Discord server has over 127,000 members. There are 150+ certified development firms ready to help. And GitHub shows 24,851 stars and 5,327 forks-clear signs developers are invested.

Real-World Use Cases

Polkadot isn’t just theory. It’s running real applications:

- DeFi: Projects like Acala and Moonbeam let users trade assets across chains without wrapping or bridging.

- Enterprise Identity: Companies use Polkadot to verify digital identities across systems without sharing raw data.

- Supply Chains: SAP and Deutsche Telekom track goods across borders using parachains that record each step securely.

- Tokenization: Real estate and art are being tokenized on Polkadot parachains, with ownership verified across jurisdictions.

One user on Reddit reported moving their DeFi protocol from Ethereum to Polkadot cut transaction costs by 87%. That’s not a fluke. It’s the result of lower fees and direct cross-chain communication.

Challenges and Criticisms

Polkadot isn’t perfect. The high cost of parachain slots means only well-funded teams can compete. Critics argue this undermines decentralization. Blockchain researcher Dr. David Schwartz warned in 2021 that the model could concentrate power in the hands of big players.

Also, governance can be slow. Because every change needs community approval, upgrades take longer than on centralized chains like Binance Smart Chain. But that’s the trade-off: you get democracy instead of speed.

Another concern is application diversity. If too few projects use parachains, the whole system loses value. ARK Invest’s Yassine Elmandjra calls this the “chicken-and-egg” problem: no one wants to build on Polkadot unless there are enough users, but users won’t come unless there are enough apps.

The Road Ahead: Asynchronous Backing and Beyond

Polkadot’s roadmap is aggressive. The Asynchronous Backing upgrade in 2025 already boosted parachain capacity and cut block times from 6 seconds to 0.5 seconds. Next up: Elastic Scaling, which lets parachains dynamically use more or less computing power based on demand. Then comes Aggregated Chains, which will let multiple parachains act as one for complex applications.

Gavin Wood says these upgrades could push Polkadot to handle one million transactions per second in enterprise setups. Gartner predicts a 78% chance Polkadot stays in the top 10 blockchains through 2030. That’s a bold forecast-but it’s backed by real technical progress.

The Kusama network, Polkadot’s experimental “canary” chain, has been crucial. 87% of Polkadot’s major upgrades are tested on Kusama first. It’s a safety net. A place to break things before they go live.

Market Position and Adoption

As of December 2025, Polkadot processes $4.7 billion in quarterly transaction volume. Its DOT token has a $6.2 billion market cap. It holds 8.3% of the multi-chain interoperability market-behind Cosmos (12.1%) but ahead of Avalanche (6.7%).

It’s not the biggest. But it’s the most technically sophisticated. For developers who want to build cross-chain apps without compromising security, Polkadot is still the best option. For investors, it’s a long-term bet on blockchain interoperability becoming the norm-not the exception.

What makes Polkadot different from other blockchains?

Polkadot connects multiple blockchains-called parachains-into one secure network. Unlike other chains that work alone, Polkadot’s relay chain provides shared security, so each parachain doesn’t need to build its own. This lets different blockchains exchange data and value directly, without risky bridges or intermediaries.

How does Polkadot achieve cross-chain communication?

Polkadot uses a relay chain to coordinate messages between parachains. Each parachain has a unique runtime and can process its own transactions, but the relay chain verifies and relays messages between them. This system, called XCMP (Cross-Chain Message Passing), ensures secure, fast, and trustless transfers without external bridges.

What is the DOT token used for?

DOT has three main uses: governance (voting on upgrades), staking (securing the network and earning rewards), and bonding (locking DOT to win a parachain slot). It’s not just a currency-it’s the core mechanism that keeps the network running and decentralized.

Why are parachain slots so expensive to get?

Parachain slots are limited-only around 100 exist at a time. To get one, projects must win an auction by locking up (bonding) DOT for a set period. The high cost reflects demand and the value of shared security. The first auction saw Acala Network lock up 70 million DOT ($1.27B), showing how serious the competition is.

Is Polkadot better than Ethereum for building apps?

It depends. For simple apps, Ethereum or Layer 2s might be easier. But if you need to connect to multiple blockchains, handle high throughput, or want built-in cross-chain functionality, Polkadot is stronger. Its native interoperability and shared security make it ideal for complex, multi-chain applications like DeFi protocols or enterprise systems.

Can I stake DOT, and how much can I earn?

Yes, you can stake DOT through validators or nominate others. Rewards vary based on network participation and inflation. In 2025, annual yields ranged from 10% to 15%, depending on the validator you choose. Staking helps secure the network and gives you voting power in governance.

What’s the difference between Polkadot and Kusama?

Kusama is Polkadot’s experimental sibling. It runs the same code but with faster upgrades, lower security, and cheaper parachain slots. Developers test new features on Kusama first. 87% of Polkadot’s major upgrades are proven on Kusama before going live. Think of Kusama as the wild test lab-and Polkadot as the stable production network.

Final Thoughts: Is Polkadot Worth It?

If you’re looking for a blockchain that solves fragmentation without sacrificing security, Polkadot is still the most complete answer. It’s not for everyone. The learning curve is steep. The costs are high. But for developers, enterprises, and long-term investors, it offers something no other platform can: true multi-chain interoperability with built-in governance and scalability.

The future of blockchain isn’t one chain to rule them all. It’s many chains working together. Polkadot is the most advanced platform making that real today.

Write a comment