When you deposit ETH into a DeFi lending protocol, you expect it to be safe-locked in a vault, earning interest, and available whenever you need it. But what if that same ETH gets reused over and over again-by other borrowers, other vaults, other protocols-without your knowledge? That’s rehypothecation. And in DeFi, it’s not just possible. It’s widespread. And it’s one of the most dangerous hidden risks in crypto today.

What Rehypothecation Really Means in DeFi

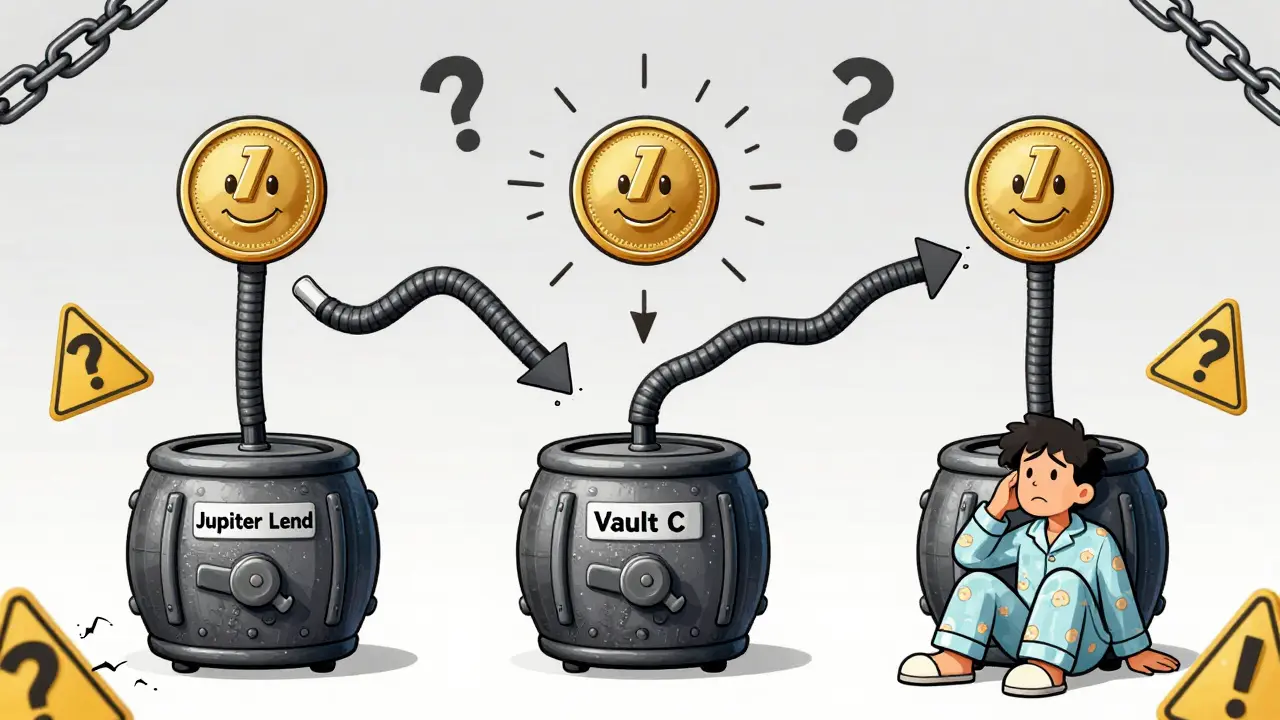

Rehypothecation sounds like a Wall Street buzzword, but it’s simple: it’s when someone uses your collateral to back someone else’s loan. In traditional finance, banks take your stocks or bonds as collateral for a loan, then turn around and lend those same assets to another client. It’s legal, regulated, and capped at 140% of your liability in the U.S. But in DeFi? There’s no cap. No oversight. No legal recourse. In DeFi, your deposited ETH or USDC doesn’t just sit there. Smart contracts automatically reuse it. Maybe your ETH backs a loan on Jupiter Lend. Then that same ETH gets used as collateral for another loan in a different vault. Then again. And again. Each reuse multiplies the leverage in the system. One dollar of your collateral can end up supporting five, ten, even twenty dollars in loans. That’s not efficiency-it’s a house of cards.The Jupiter Lend Crash: A Real-World Wake-Up Call

On August 17, 2024, $42 million in user funds got frozen across Jupiter Lend’s vaults. Not because of a hack. Not because of a smart contract bug. Because of rehypothecation. Jupiter Lend marketed its vaults as “isolated.” Users thought their assets were locked away, safe from what happened elsewhere. But behind the scenes, dozens of vaults shared the same underlying collateral pool. When one vault got liquidated during a 15% market dip, the ripple effect triggered cascading liquidations across other vaults. Your ETH wasn’t just sitting in your vault-it was tied to someone else’s risky position. And when that position failed, your assets got locked too. 14,382 users lost access to their funds for days. Some couldn’t withdraw for 72 hours. One Reddit user, u/CryptoHodler87, lost $12,500. He said: “They claimed my vault was isolated. But when another vault using the same collateral pool got liquidated, my assets got frozen.” The SEC stepped in. On February 12, 2025, they fined Jupiter Lend for misleading disclosures-the first regulatory penalty in DeFi specifically targeting rehypothecation.Why DeFi Rehypothecation Is Worse Than Traditional Finance

In traditional markets, rehypothecation is tracked, limited, and audited. Regulators like the SEC and Fed enforce rules. If a broker goes under, client assets are protected. In DeFi? There’s no such thing. - Regulation: U.S. prime brokers can’t rehypothecate more than 140% of your liability. DeFi protocols? No limits. 83% of major lending protocols do it, according to Chainalysis. - Transparency: Traditional banks give you statements. DeFi protocols? Only 18% clearly disclose rehypothecation in their docs, per DeFi Safety’s 2024 audit. - Recourse: If your broker misuses your assets, you can sue. In DeFi, you’re bound by a smart contract with no legal standing. 92% of DeFi protocols don’t even mention rehypothecation in their terms, according to the Smart Contract Research Forum. And here’s the kicker: DeFi’s “transparency” is a myth. Just because a contract is on-chain doesn’t mean you can easily trace how your assets are being reused. You need blockchain analysis skills, time, and tools most users don’t have.

How Rehypothecation Creates Hidden Leverage

Think of collateral like water in a pipe. In a normal system, water flows one way: you deposit, you borrow, you repay. In a rehypothecated system, the same water gets pumped through multiple pipes, each time increasing pressure. A single ETH deposited in Vault A might secure a loan in Vault B. That loan’s collateral gets reused in Vault C. Vault C’s assets back a leveraged position in Vault D. Each step multiplies the exposure. Researchers estimate rehypothecation can boost capital efficiency by 300-500%. But that efficiency comes at a cost: systemic fragility. During the March 2023 crypto crash, protocols with aggressive rehypothecation saw average collateral shortfalls of 68%. That means for every $100 in collateral pledged, $68 was missing when needed most. The Blockchain Transparency Institute found a 78% correlation between rehypothecation intensity and protocol insolvency risk during that crash.How to Spot Rehypothecation Risk Before You Deposit

You can’t avoid DeFi. But you can protect yourself. Here’s how:- Check the fine print. Look for terms like “collateral reuse,” “cross-vault liquidity,” or “shared backing.” If it’s buried in a whitepaper or glossary, that’s a red flag.

- Use blockchain explorers. Go to Etherscan. Trace the flow of your collateral. If your ETH shows up in multiple lending contracts, it’s being reused.

- Use tools. DefiLlama’s risk dashboard, Blocksec’s rehypothecation tracker, and Chainalysis’s new Rehypothecation Risk Scanner (released October 2024) show which protocols are risky.

- Ignore “isolated vaults”. That marketing term means nothing if the underlying assets are shared. The OneSafe.io analysis found 73% of user errors come from assuming isolation = safety.

- Watch collateral utilization ratios. If a vault is using 85%+ of its collateral for loans, it’s already stretched thin. Anything above 75% is dangerous during volatility.

What the Smart Players Are Doing Differently

Not all DeFi protocols are playing Russian roulette. Some are fixing the problem. - Aave v3 (since October 2024): Shows exact collateral reuse ratios for each isolated pool. You can see how many times your asset is being reused. - Compound (since November 2024): Added circuit breakers that pause cross-vault collateral use during market spikes. - MakerDAO (December 1, 2024): Launched “single-collateral exposure” vaults-no reuse allowed. These aren’t gimmicks. They’re safety features. Messari’s Q4 2024 report showed protocols with transparent rehypothecation disclosures had 47% lower insolvency rates during market stress. And institutional investors are noticing. Galaxy Digital found 92% of institutional DeFi allocations in Q3 2024 went to protocols with clear risk disclosures. If big money is avoiding opaque systems, you should too.What You Should Do Right Now

If you’re using a lending protocol today, here’s your action plan:- Don’t max out your loan-to-value ratio. Keep it under 65% during volatile markets. Higher leverage means more liquidations.

- Diversify your collateral. Don’t put all your ETH in one protocol. Spread it across platforms with different risk profiles.

- Only use protocols that disclose rehypothecation. If they don’t say it outright, assume they’re hiding it.

- Use the new tools. Chainalysis’s scanner and DefiLlama’s risk dashboard are free. Use them.

- Stay updated. The DeFi Safety Council’s new disclosure standard (launched September 2024) is forcing protocols to be clearer. Check if your platform complies.

The Future: Regulation, Tech, and Transparency

The tide is turning. The SEC’s Jupiter Lend fine wasn’t a one-off. ESMA in Europe is proposing similar rules. Ethereum’s upcoming EIP-7272 (Q2 2025) will let wallets natively track collateral reuse chains. The World Economic Forum is working on a “Rehypothecation Risk Index” expected in Q1 2026. But here’s the truth: even with better tech and regulation, some protocols will keep hiding leverage. They need it to offer high yields. And users still chase those yields without understanding the risk. The real solution isn’t regulation-it’s awareness. You need to know what’s happening to your assets. You need to ask hard questions. You need to choose safety over hype. Because in DeFi, the biggest risk isn’t the market crashing. It’s thinking your money is safe when it’s not.What is rehypothecation in DeFi?

Rehypothecation in DeFi happens when a lending protocol uses your deposited crypto as collateral to back other loans-without your explicit permission. Your ETH or USDC might be reused multiple times across different vaults or borrowers, creating hidden leverage that can trigger cascading liquidations during market downturns.

Is rehypothecation illegal in DeFi?

It’s not illegal, but it’s unregulated. Unlike traditional finance, where laws limit rehypothecation to 140% of client liability, DeFi has no legal caps or oversight. Many protocols hide it in fine print. The SEC fined Jupiter Lend in February 2025 for misleading users about rehypothecation, signaling that regulators are starting to act.

Can I see if my assets are being rehypothecated?

Yes, but it’s not easy. You need to use blockchain explorers like Etherscan to trace where your deposited assets are flowing. Tools like Chainalysis’s Rehypothecation Risk Scanner and DefiLlama’s risk dashboard now show which protocols reuse collateral. Look for terms like “shared liquidity” or “cross-vault backing” in protocol docs.

Are “isolated vaults” safe from rehypothecation?

Not necessarily. Many protocols market “isolated vaults” as safe, but they still share underlying collateral pools. The Jupiter Lend crash proved this-users thought their vaults were isolated, but assets were reused across multiple vaults. Always check the technical documentation, not the marketing.

Which DeFi protocols avoid rehypothecation?

Aave v3, MakerDAO’s new single-collateral vaults, and Compound (with circuit breakers) now disclose or limit collateral reuse. These are among the safest options. Always check their official documentation for explicit statements on collateral reuse ratios. Avoid any protocol that doesn’t clearly explain how your assets are used.

How can I protect my assets from rehypothecation risk?

Keep your loan-to-value ratio below 65%, diversify your collateral across multiple protocols, and only use platforms that transparently disclose rehypothecation. Use tools like DefiLlama and Chainalysis’s scanner to assess risk. Avoid chasing the highest yields-they often come with the highest hidden leverage.

Yashwanth Gouravajjula

17 Dec 2025 at 08:29DeFi is just Wall Street with worse UX and no lawyers. If your ETH is being reused like a shared Uber ride, you’re not earning interest-you’re funding someone else’s gamble.

Stop trusting marketing. Check Etherscan. Or don’t invest at all.